Forex news for US trading on January 17, 2018

- Bank of Canada hikes interest rates to 1.25% from 1.00%

- Poloz: Today's hike validates what we saw in the marketplace

- BOC's Wilkins: Wages don't appear to be source of inflation at this time

- The full statement from the Bank of Canada

- Beige Book: Economy continued to expand, some firms expect wage rise

- US Dec industrial production mm 0.9% vs 0.5% exp

- Fed's Kaplan makes a hawkish shift

- Kaplan: Sees 2.50%-2.75% GDP growth this year, a bit slower next year

- Fed's Evans: Expect strong growth this year and next

- New Zealand REIZN house sales -10.1% vs -8.9% prior

- Senate committee sets Goodfriend's confirmation hearing date for Jan 23

- Trump actually said some negative things about Russia

- Trump says he hopes there won't be a trade war with China but "if there is, there is"

- Germany's Merkel says key points of coalition deal can not be renegotiated

Markets:

- Gold down $9 to $1329

- WTI crude up 15-cents to $63.88

- S&P 500 up 26 points to 2802

- US 10-year yields up 3 bps to 2.57%

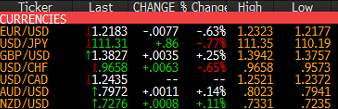

- GBP leads, JPY lags

It's been a wild day in just about every market out there. The dollar was all over the place as it sank for most of the day then started on a big reversal after the Beige Book.

EUR/USD climbed up to 1.2290 from 1.2200 and it looked like the dollar-rout was back on but in the past few hours it's completely turned around and the euro is slated to close at the lows at 1.2182.

USD/CAD was a big focus on the day and the BOC added an extra but of drama to the US trade. The pair jumped on the headlines, sensing a dovish hike but a second long and the BOC press conference made the market a bit less confident and the pair dropped back to 1.2375 from a high of 1.2520. But along with everywhere else, the dollar is in a bounce at the moment and it's back up to 1.2435, which is basically flat on the day.

USD/JPY finished at the best levels of the week at 111.30 after finding support a few times near 110.60. Rising Treasury yields are helping to underpin USD/JPY and the US dollar in general.