Forex news for traders on July 17, 2017.

- US stocks end the day with small changes

- It's "Made in America" Week (except if you're a Trump)

- Forex technical analysis: NZDUSD falls away from high area

- US crude oil future settle at $46.02, down -$0.52

- Upcoming key events and releases

- Gold moves back above 200 day MA today

- European stock indices mostly lower

- Forex technical analysis: USDJPY sprints to resistance and stalls

- Forex technical analysis: EURJPY moves to key resistance

- Forex technical analysis: EURUSD buying heats up

- Citi says GBP/JPY is the trade of the week

- US stocks open with mixed results

- Carney talks about moving away from libor

- Canada June existing home sales -6.7% vs -6.2% prior

- IMF bumps French GDP forecast, cheers planned reforms

- July Empire Fed manufacturing index 9.8 vs 15.0 expected

- Empire Fed manufacturing survey is coming up next

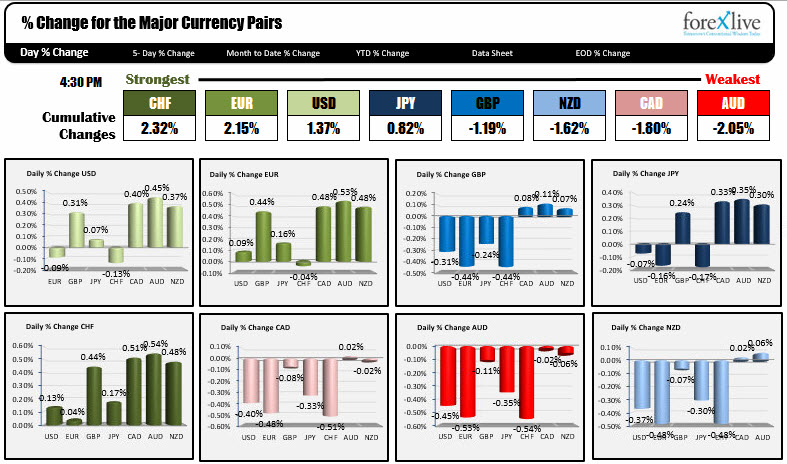

- The strongest and weakest currencies as NA traders enter for the day

In other markets today, the end of day snapshot shows:

- Spot gold up $5.43 or 0.44% to $1234.13

- WTI crude oil is ending down -$0.56 or -1.18% to $45.98

- US stock indices were little changed. The S&P was down -0.1%. The Nasdaq closed up 0.03% and the Dow ended lower by -0.04%.

- US yields area ending unchanged to down 2 bp. 2 year 1.3557% , unchanged. 5 year 1.8561%, down -1 bp. 10 year 2.312%, down -2 bp. 30 year 2.902%, down -1.7 bp.

The USD was mixed in a quiet Monday trading session. The greenback fell vs. the EUR (-0.09%) and the CHF (-0.13%), but rose vs. the GBP (+0.31%), CAD (+0.40%), AUD (+0.45%) and the NZD (+0.37%).

Was it anything in the news that was a catalyst for moves?

It is "Made in America" week in Washington. Did that help? Not really. The market wants to see tax cuts and "Repatriation Week". A photo shop with Trump looking at big trucks did not do much.

Was it the Empire Manufacturing index? That index came in lower than expected, but it did not really have an impact.

Did a Fed official say something? No...the gag order is on the Fed as they prepare for their meeting next week. No Fed comments all week and besides, the expectations are for no change anyway.

How about anything in Europe? Nothing. The ECB meets on Thursday and that statement and Draghi presser has the potential to really get things going. Nevertheless, the EURUSD is closing above the 1.1435-65 area for the 2nd consecutive day. Stay above this area is more bullish for the pair. However, traders will be looking for a move above the 1.1500 level to help confirm the move.

Gold was higher by about $5, but did not move much in the NY session.

Stocks were virtually unchanged. That was not a catalyst either.

Crude oil was down about -$0.50 which may have given the US a bid against the CAD (the USDCAD did rise by 0.40% in trading today). Technically, the USDCAD moved back above the swing lows from June 2016 at 1.2654 and 1.2676 respectively. Those levels are risk level for buyers looking for the bottom in the pair (again).

For the AUDUSD, the pair was higher at the start of the day, but could not extend but 3 or so pips above the April 2016 high price of 0.7834. The high price reached 0.78377 to be exact That failure was enough to make the longs think twice about expecting higher highs, and the price wandered back lower into the close. If the high is in place (let's call it a double top), a move below 0.7777, 0.7755 and 0.77307 are the next steps that - if broken - would give sellers more ammunition.

While the EURUSD was going higher today, the GBPUSD was going the opposite direction. The UK CPI data is out in the new day and the expectations are for the headline to come in at 2.9% unchanged from the prior month, and the core at 2.6% - also unchanged. Traders thought it best to take the price a little lower into the data.

The NZDUSD CPI - this one is for the whole 2Q - is also out in the new day. In Q1 the prices rose by 1.0%. The expectations are for a rise of 0.2% in the current quarter. The NZDUSD is positioning between support and resistance. For those levels, check out my post here.

Have a better Tuesday. It should not be hard to beat Monday.