Forex news for trading on Juen 20, 2017.

- US stocks end the day near lows for the day

- Kaplan: His goal on balance sheet reduction is to minimize impact on bond/MBS mkts

- More Kaplan: Monetary policy no substitute for structural reform

- Feds Kaplan: Sees 2% GDP growth in 2017

- Crude oil futures settle lower at $43.23.

- Dollar advances in the NY session, but stalling a bit

- Speaker Ryan on CNBC now

- France stats bureau sees best growth since 2011

- Deal between UK Conservatives and DUP likely to be announced Thurs - BBC

- New Zealand GlobalDairyTrade auction -0.8% vs +0.6% prior

- OPEC touts high compliance

- Fed's Evans: I expect inflation to rise but I'm nervous

- Fed's Evans lays out the possible FOMC playbook

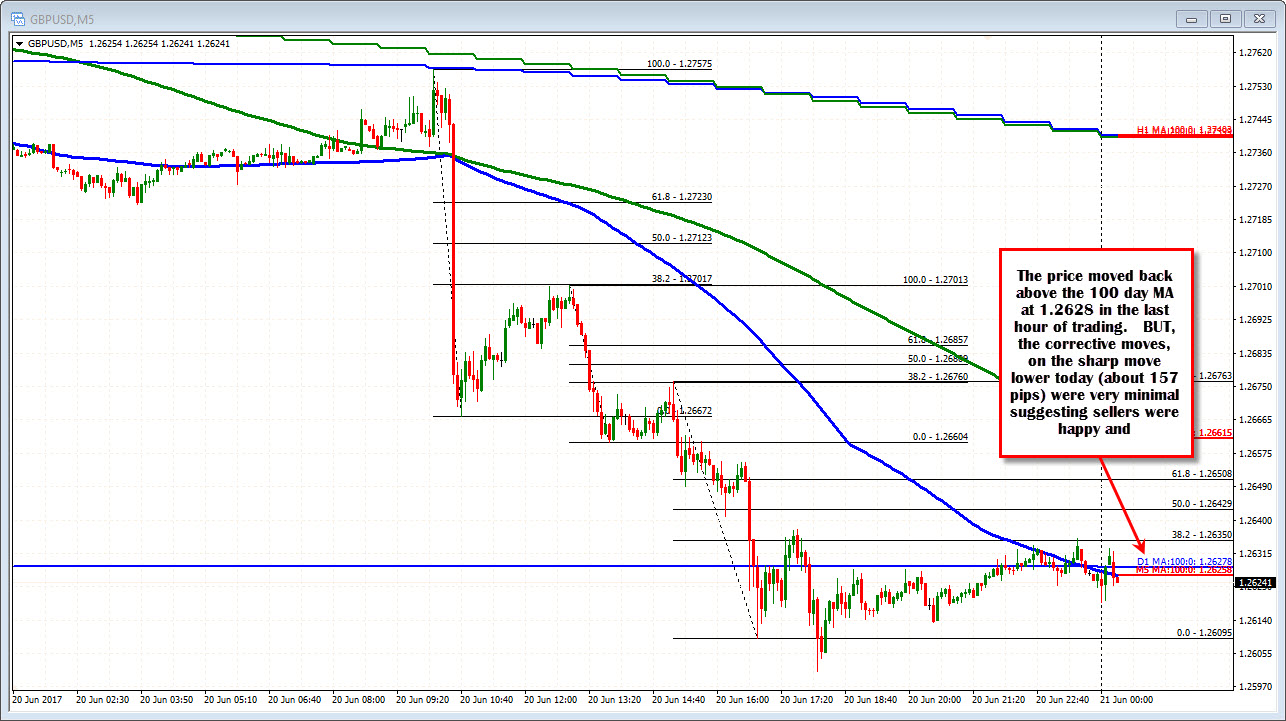

- GBPUSD moves below 100 day MA. Trades at lowest level since snap election announcement

- Oil hits the lowest since November as over-supply glut continues

- Belgian consumer sentiment falls to -2 from 0 in May

- Philadelphia Fed April non-manufacturing regional index 33.6 vs 25.6 in May

- Canada April wholesale sales +1.0% vs +0.5% expected

- US Q1 current account deficit $116.8B vs $123.6B expected

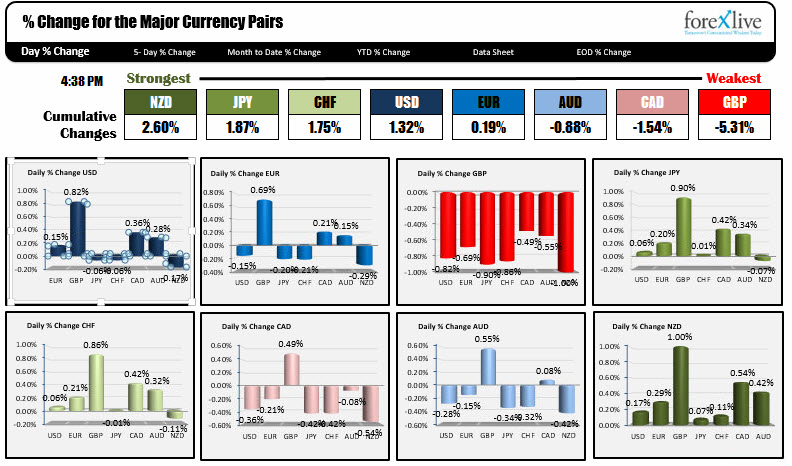

- The strongest and weakest currencies as NA trader enter for the day

In other markets today:

- US stocks ended near lows for the day. The Nasdaq was the most vulnerable with the index down -0.82%. The S&P was down -0.67%. The Dow was down -0.29%

- US yields were lower: 2 year 1.3439, down -1.2 bp. 5 year 1.7599%, down 2.8 bp. 10 year 2.1547%, down -3.3 bp. 30 year 2.733%, -5 bp

- Spot gold is trading at $1242.85, down -$0.50 or -0.04%

- The June Crude oil contract settled (and will go off the board) at $43.23, down -$0.97 or -2.19%

Another quiet day on the US economic calendar. The current account deficit came in lower than expectations at 116.8B vs 123.6B. That is good news but not sure traders were particularly focused on the implications of 7 or so billion.

Two Fed members - Evans and Kaplan - talked during the NY session and although they expect rates to rise and the Fed to start the balance sheet unwind, they don't expect to be in too much of a hurry. Evans said you have to raise rates in order to lower them if there is a recession. HMMMM. The Fed is worrying about not having any tools should the economy crater. Raise rates now, so you can cut them later.

The Fed officials are also worried that lower inflation, although thought to be transitory, is still a concern. Kaplan is worried about the yield curve flattening and said that he "Can't wait" for signs of over-heating inflation. He also said the Fed needs to be "careful about raising rates further if the 10 year treasury yield stays where it is". The US 10 years is trading below its 200 day MA and was down about 3 bp to 2.154% today.

The GBP was the weakest currency today and perhaps had the biggest story. BOEs Carney said in his delayed Mansion House speech, that now was not the time to raise rates. That allayed some of the fears from the 5-3 vote last week where three members wanting to raise rates due to higher inflation. Most of the downside damage was done in the London morning session but there was some residual selling of the pound in the NY session as well.

The CAD was also weak today after crude oil prices fell over 2% on supply concerns. The CAD has been largely ignoring the impact of lower oil, but today was hard to ignore (the price dipped below the $43.00 level to $42.75 low).

What are the technicals saying for some of the major pairs going forward?

The EURUSD extended a 24 pip trading range at 8:00 AM to a 46 pip trading range by the end of the day. It is still short of the 68 pip average seen over the last 22 trading days (about a month of trading) but it is respectable at least. The price fell below the low from last week at 1.1131 and in the process also fell below the 200 bar MA on the 4-hour chart at the same area. The next target is the end of May low at 1.1108. A broken trend line on the daily chart cuts across at 1.1105 (not far from that level). The low reached 1.1181 today. The price moved back up to the 1.1131 level at the close which could lead to more upside potential in the new day if broken (with more momentum. The 1.11609-71 - home to many swing lows and highs going back to mid-May is a big line in the sand for sellers. A move back above that area and the sellers give up. Get below 1.1105 and there is room for more selling.

As mentioned above, the GBPUSD was under pressure for most of the trading day. The GBPUSD fell below it's 100 day MA at 1.2628 on two separate occasions today. The first move stalled and moved modestly higher. That corrective move stalled around the 38.2% of the last trend leg down today (that is not the 38.2% of the move down, just the last leg lower -see chart above). The second break below the 100 day MA tried to keep a lid against the 100 day MA line, but in the last hour or so, the price wandered a few pips above. It is not a disaster. The market is more or less going sideways. What it says, however, is the market wants to digest that key MA level. We could move higher from here. We could move lower. The sellers are still more in control as buying today was minimal at best.

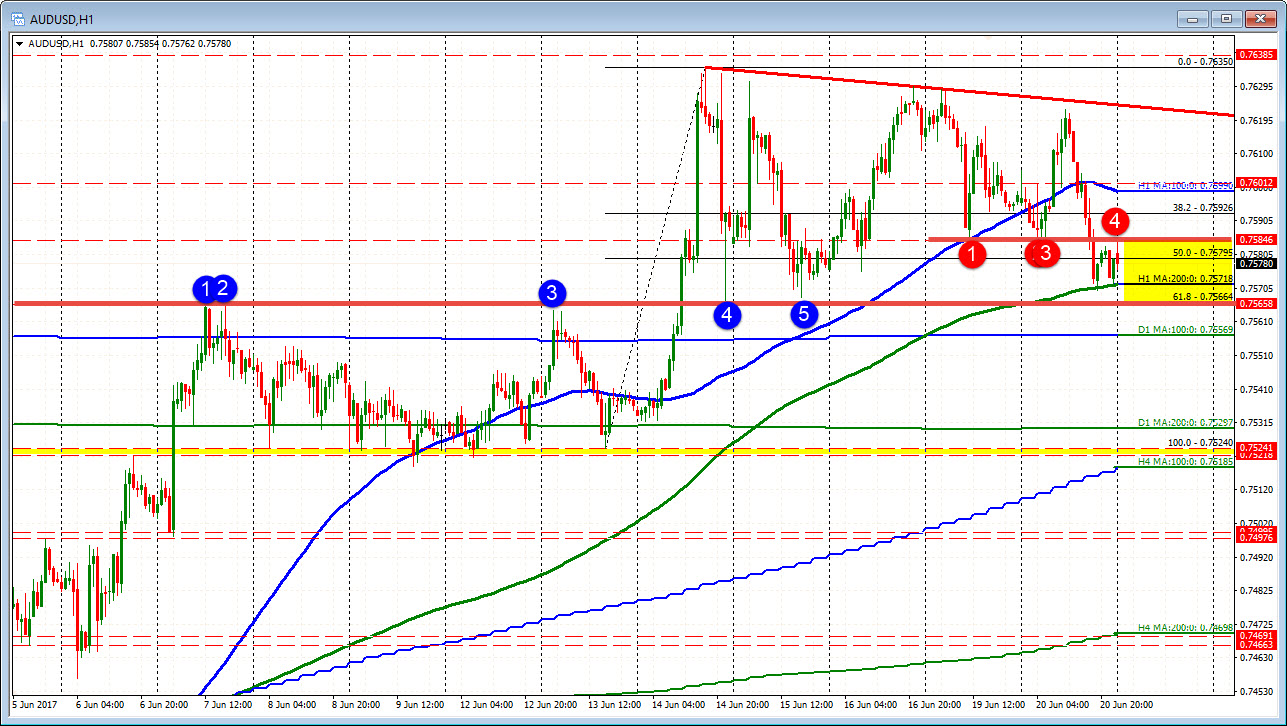

The AUDUSD fell to session lows in the NY session but found support buyers near key support defined by the 200 hour MA (green line in the chart above) and the 0.7566 level. That level was a ceiling pre-June 14, and a floor post- June 14 (see thick red line). Stay above the 0.7566 is good for the dip buyers. Move below is not good for the dip buyers. ON the topside the 0.7584 lows from yesterday and earlier today is a level that if broken above, would give the dip buyers more happiness. The price just stalled at 0.7585 as the new day gets started. That is resistance and 0.7566 is support. Look for the break.

The gains in the USDCAD on the back of lower oil prices were eroded in NY trading but there was a little bit of a rebound into the close. The pair is back above the most recent swing highs on the hourly at 1.3262 and 1.32568 (see yellow area). The move back toward the 100 hour MA at 1.3242 was avoided as well (in the new day, longs./buyers DO NOT want to see the 100 hour MA re-broken to the downside). A move below and the 1.3208-11 becomes a support target. On the topside, the 200 hour MA and 38.2% retracement at 1.3306 is close to the high from Friday at 1.33075. Key level to get above if this pair is going higher.

------------------------------------------

Below are the % changes of the major currencies vs each other.