Forex news for US trading on November 20, 2017:

- Yellen to quit. Won't stay on as governor

- BOE's Ramsden: The fall in sterling after Nov hike was a result of pre-hike rise

- Ramsden: There may be more economic slack than headline numbers suggest

- Trump: We're designating North Korea a state sponsor of terror

- Merkel: Not planning a German minority government, unafraid of new elections

- Draghi warns on geopolitical risks and a market correction

- BOE expands term funding scheme by 25 billion pounds

- Oct US Conference Board leading index +1.2% vs +0.8% expected

- ECB's Draghi: Economic expansion remains solid and broad-based

- SPD's Schulz says he assumes there will be a new election

Markets:

- Gold down $17 to $1277

- WTI crude down 46-cents to $56.09

- S&P 500 up 3 points to 2582

- US 10-year yields up 2 bps to 2.365%

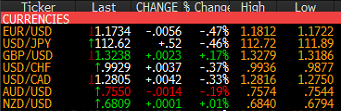

- GBP leads, EUR lags

The US dollar and stocks like quiet days. The dollar was weaker in Asia and early in Europe but it held a steady bid throughout New York trade and that helped it to the top of the chart, just behind the pound.

Headlines weren't a factor aside from the continuing developments in Germany. At the moment, EUR/USD is back down near the opening low of 1.1722 after touching above 1.1800 in London. It's been a steady slide lower.

The leading index jump matched the best since 2013 and it was a reminder that economic news for the dollar has been good lately, despite the dip in USD/JPY. That pair hit a low of 111.89 and was tracking around the figure as New York arrived. From there it was steadily higher up to 112.60 last.

Commodity currencies were also under pressure. AUD/USD slipped a dozen pips lower despite a two-year high for iron ore. More broadly, commodities were weak and AUD/USD hedged down to 0.7550 from 0.7565.

The move in USD/CAD was more pronounced as it climbed to 1.2810 on the combination of USD strength and softness in oil. The Friday high of 1.2823 will be one to watch in the day ahead.

The pound was generally able to withstand USD dollar strength in North America but not entirely. Cable had been as high as 1.3279 but tracked down to 1.3238. The good news is that Theresa May does appear to be making some headway on Brexit negotiations.