Forex news for NY trading on December 21, 2017.

- Spain - Catalan secessionists on track to win majority in today's regional election

- US stocks end with gains but off the highs at the close

- Goldman Sachs is said to be building a cryptocurrency trading desk

- US crude oil futures settle at $58.36

- US House clears way for debate and vote for temporary federal govt funding bill.

- The ups and downs continues for the GBPUSD

- Larry Lindsey is being considered as Fed Vice Chair

- A look at the markets at midday

- Boeing has been in takeover talks with Embraer - report

- You will soon be able to short Bitcoin futures in your E*Trade account (if you have $200,000)

- It turns out Bitcoin Investment Trust really was overvalued

- Bitcoin tests key floor level - and falls below. More bearish for bitcoin.

- Huge options bet shows how Wall Street is diving into crypto currency

- UK FTSE trades above 7600 for the first time. Up 1% on the day. Record high.

- December advance eurozone consumer confidence +0.5 vs +0.2 expected

- US Oct FHFA house price index +0.5% m/m vs +0.4% expected

- US Dec Philly Fed business outlook 26.2 vs 21.0 expected

- US initial jobless claims 245K vs 233K estimate

- Canada October retail sales +1.5% m/m vs +0.3% expected

- US Nov Chicago Fed national activity index +0.15 vs +0.50 expected

- US GDP annualized 3Q (third revision) 3.2% vs. 3.3% estimate

- Canada November CPI +2.1% vs +2.0% y/y expected

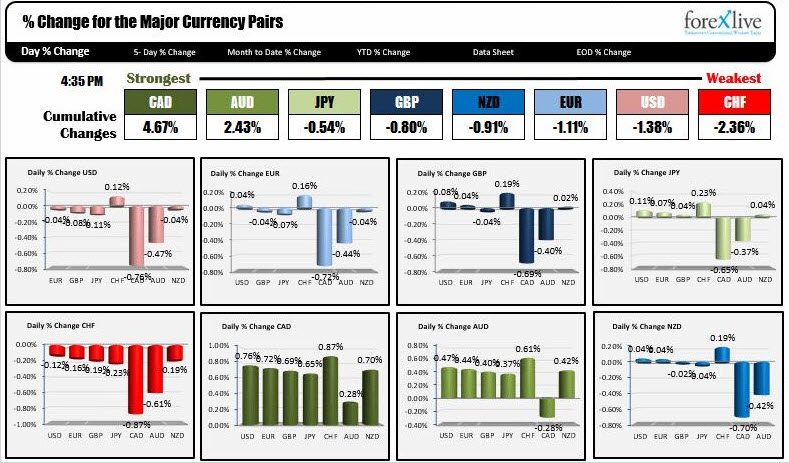

- The CAD is the strongest. The CHF is the weakest as NA traders enter for the day

- ForexLive European FX news wrap: Dollar holds steady as FX markets consolidate in tight range

In other markets, a snapshot is showing:

- Spot gold is up $1.50 or 0.12% at $1267.05

- WTI crude oil futures are up $0.15 or +0.26% at $58.24

- US yields are mixed with a flatter yield curve: 2 year 1.8775%, up 2 bp. 5 year 2.24%, up 0.3 bp. 10 year 2.479%, down 1.8 bp. 30 year 2.479%, -1.8 bp

- The US major stock indices closed higher but off highs. For a rundown, click here.

Oh Canada!

It was the US's neighbor to the north that stole all the thunder in trading today. Both retail sales and CPI came in better than expectations (especially the retail sales numbers) and that sent the loonie racing to the upside. Even with a late day corrective move, it remained the strongest of all (see the table below).

For the USDCAD it fell to 1.2700 and below a swing level in the 1.2712-218 area., but was able to correct to 1.2732 near the close. The 200 bar MA on the 4-hour chart at 1.27772 was a level broken on the way down and successfully tested after the fall.

In the US today, the third cut of the 3Q GDP came in a touch weaker than expectations at 3.2% vs 3.3%. You can blame a tick down in consumption for the small decline but 3.2% or 3.3% it is still above the 3% bogey.

The AUD was also a better mover today. It jumped on the commodity band wagon. A US tax cut in December, and a January infrastructure plan to come, should be a benefit for commodities in general. For the AUDUSD, it cracked back above it's 200 day MA at 0.76908 - after trading and closing below it since November 3rd. There are a boatload of options expiring at 0.7700 tomorrow (click here), which may keep the pair close to that level, but bulls made a play today and staying above the 200 day MA would keep the technicals in the bulls favor.

The other pairs wandered up and down.

The GBPUSD has been trading between 1.3329 and 1.3418 this week. The low today reached 1.3330 and bounced. In between the two extremes sits the 100 and 200 hour MAs at 1.3372. We are closing above those MAs which keep the buyers from the low extreme... happy (above those MAs). A move below and the feeling of happiness can fade away.

The EURUSD traded in a 41 pip range and closed near the middle of that range. The 1.1876 was the swing low going back to June 2010. The high in the NY session reached 1.1878. Maybe I am making too much of the level. Nevertheless, the pair is trading above and below it over the last day.

The USDJPY has a trend line on the daily at 113.42 going into the new trading day. The price move above that line today but stalled and moved back lower. Stay below is more bearish in the new day.

To all those in Asian Pacific session who will be enjoying your families and friends during the NY session tomorrow, let me take this moment to wish you a happy and joyous Christmas. Peace.