Forex news for trading on July 21, 2017.

- The Nasdaq string of higher levels is over. Small declines for indices today

- CFTC Commitments of Traders: JPY shorts increase. Eur longs also see an increase

- Gold breaks higher. Back above 100 day MA and 50% retracement.

- US crude oil futures settle at $45.77/BBL

- Scaramucci is in the house

- Is Spicer's departure part of a bigger shakeup?

- This tweet (and video) by Trump's new communication advisor is a bad start

- Baker Hughes US oil rig count 764 vs 765 prior

- S&P raises Greece's outlook to positive

- So long Sean Spicer. White House spokesman resigns over new boss

- WTI falls $1 as the rejection of the July high continues. Levels to watch

- ECB's Weidmann told German cabinet that now isn't the time for tax cuts

- European stocks end the week on a sour note (for longs that is)

- Watch for position-squaring in AUD/USD - Credit Agricole

- NY Fed Nowcast estimate for Q2 GDP rise to 2.0% from 1.9% last week

- USDJPY falls below lower trend line. New session lows.

- Lawyer who met Trump represented Russian spy agency for years

- Canada May retail sales +0.6% vs +0.3% expected

- Canada June consumer price index +1.0% vs +1.1% y/y expected

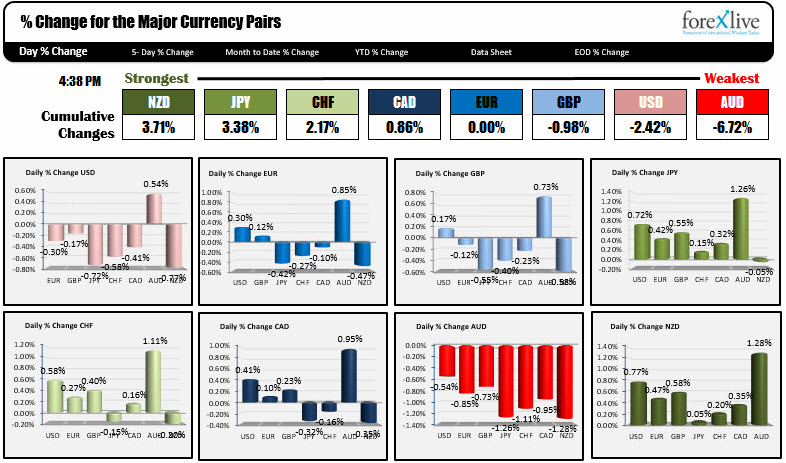

- The strongest and weakest currencies as NA traders enter for the day

In other markets, a snapshot shows:

- Spot gold rose $10.45 to $1254.90

- WTI crude oil fell $1.32 to $45.61

- US yields were lower with the 2 year at 1.3402%, down -1 bp. 5 year 1.8013%, down -1.5 bp. 10 year 2.237%, down -2.1 bp. 30 year 2.809%, down -1.6 bo

- US stocks ended with modest declines. Nasdaq down -2.25 points or -0.04%. S&P down -0.91 points or -0.04%. Dow down -31.71 points or -0.15%

There was no US data in the US trading session today. The news came from Canada which saw May retail sales rise by a greater than expected 0.6% (vs 0.3% estimate). CPI headline data come in at 1.0% vs 1.1% but the core measures was 0.1% higher than expectations. That helped to keep the CAD better bid (sent the USDCAD lower). It was another new low for the USDCAD today.

In the US today, word started to surface that Trump was going to hire Anthony Scaramucci as Director of Media communications. Scaramucci, ex-Goldman, Wall Street hedge fund manager worked for Trump during his campaign despite calling him a "hack" in the past. Sean Spicer, perhaps the most renowned press secretary in the history of press secretaries, either fell on the sword to give the new boss a clean slate (and not have to decide between him and Sarah Sanders), or looked at the opportunity to get outta Dodge. Either way, no more "Spicey" on SNL, which is a shame. How Melissa McCarthy happened into that role was pure brilliance, but all good(?) things, come to an end. Maybe Spicy and the RealSpicey will go on the road together (with driving podiums).

Anyway, Scaramucci showed up at the press briefing. The camera's were allowed in for a change, and quite frankly he shined (I always enjoyed him when he was on CNBC). Whether he can get President Trump to stop the tweeting, and start listening and talking to his inner circle (vs the world outside), Trump won't have to play so much politics and the cards would fall more easily in place (assuming all the loose ends get tied up). Hope springs eternal.

Stocks closed lower today with the Nasdaq breaking it's 10 day winning streak. Earnings were not bad this week. Next week, the market highs will be tested with Google announcing on July 24th, AMD, Chipotle, Amgen, Caterpillar, AT&T on July 25th, Coca Cola, Boeing, Facebook announcing on July 26th. Conoco Phillips, Twitter, Bristol Myers Squibb, Amazon announcing on July 27th.

Whether one is feeding off the other but if the dollar declines, the stocks like it. That could turn the other way but for now a lower dollar with low inflation is ok. Exporters benefit and if there is some import inflation, it is not that much of a problem (plus Trump wants to promote Made in America anyway).

The dollar did fall again today with the greenback losing ground against all the major currency pairs, with the exception of the AUD.

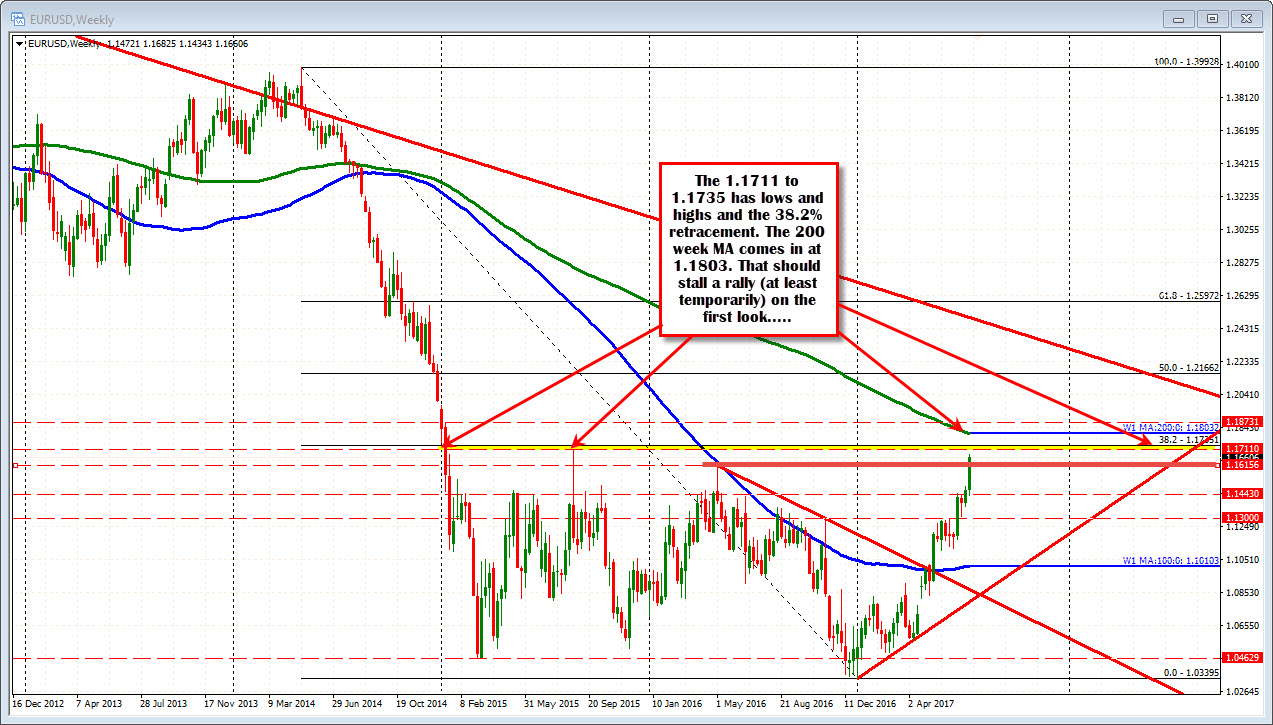

The EURUSD traded to the highest level since the August 24, 2015 spike, that saw the pair move up to 1.1711. The high price today reached 1.16825. For the week, the pair was up 4 of 5 days. The low on Monday based at 1.1434. We all remember the 1.1435-65 resistance area that the pair had to get to and through. Well it got through it and closed above the key ceiling on each trading day this week. On Thursday, the pair moved above the high price from 2016 at 1.16156 and stayed above it on Friday (low reached 1.1617). That is a close risk level for longs into the new trading week. ON the topside the 1.1711 is high from August 2015, the 38.2% of the move down from the 2014 high comes in at 1.1735. The 200 week MA comes in at 1.1803. The speculative position is long the EUR and those specs seem to have some trading clout. So as long as the price stays above 1.1615, the buyers are in firm control A move below muddies the water a bit but ultimately it still is about 1.1435-65.

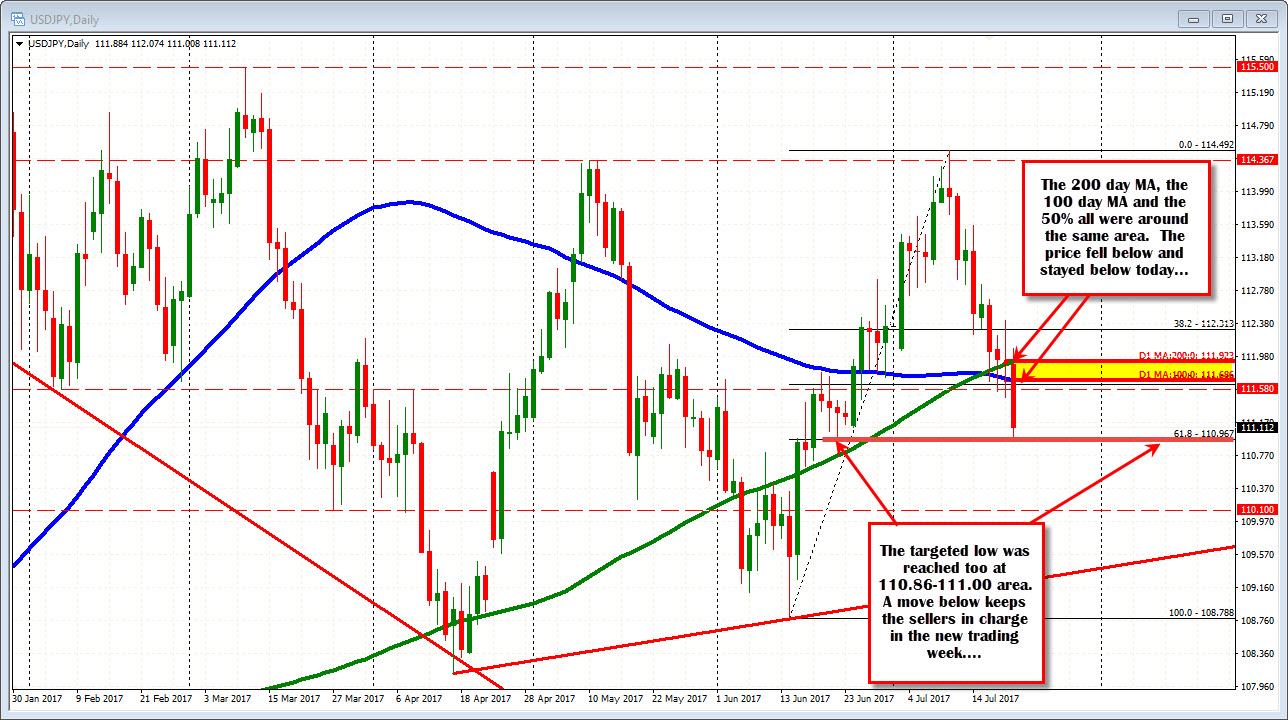

The USDJPY move to the lowest level since June 22nd. In the process, the pair finally pushed below the 200 day MA, the 100 day MA, the 50% retracement in the 111.64-111.92 area. That area (it varied in the week) was broken on Wednesday and Thursday, but the breaks failed. Finally today, the 3rd time was a charm (see Forex technical analysis: Is the 3rd time a charm for the USDJPY?), and the sellers pushed the pair toward the next target at the 110.96-111.00 (the low reached 111.008). For the new week getting below the 110.96-111.00 would keep the sellers more in control. If there are support buyers against the level, however, that old cluster of resistance that was so difficult to get through this week, should keep a lid on it. If not, the buyers will be back in town....

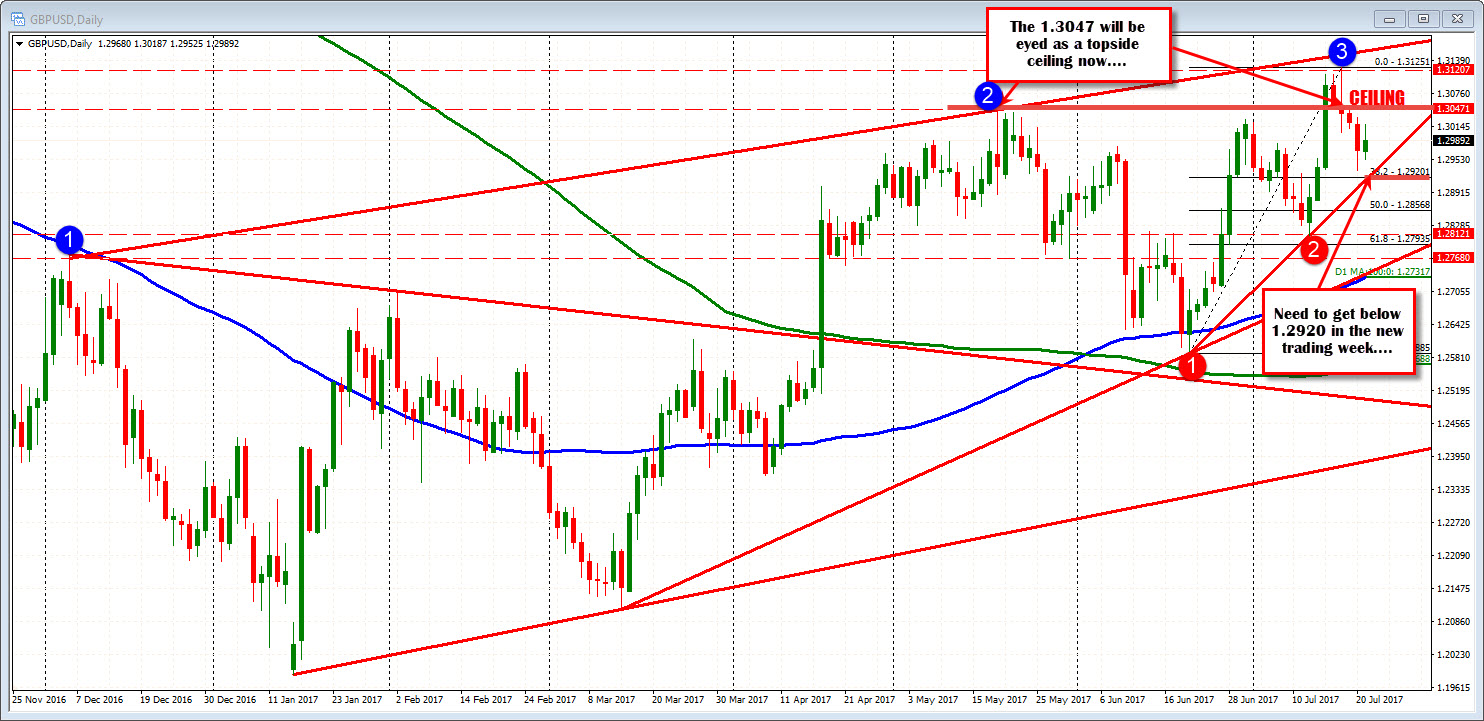

The GBPUSD - in contrast to the EURUSD - fell 4 of 5 days this week. The high on Tuesday stalled ahead of a topside trend line (it came in at 1.3150, the high could only get to 1.3125). The fall lower bottomed on Thursday at 1.2931. Friday was the only up day this week. Technically, the pair moved above the May 2017 high at 1.3047 a week ago, but could not stay above that level. The high price on Wednesday stalled around that level at 1.3051. If the price is going higher, in the new week, it needs to surprise and get back above that level. If going lower a move below 1.2920 will be eyed in the new week. A trend line and the 38.2% cut across at the level on the daily chart (see chart below).

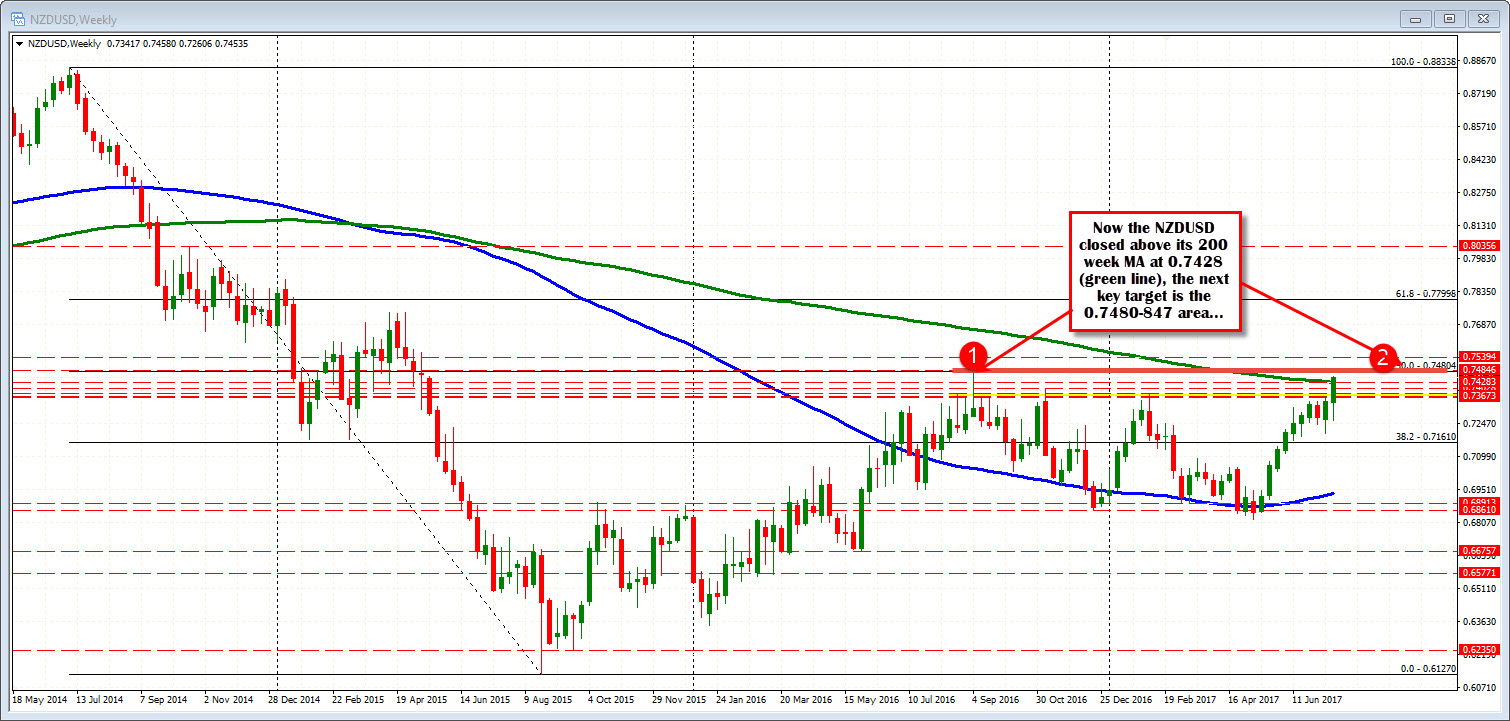

The NZDUSD closed above its 200 week MA at 0.7428. Stay above is bullish in the new week. The next target is the 50% and the high from 2016 at 0.7480-847 area (50% is 0.7480. the high from 2016 is 0.74847). The A move above that level opens the door for more upside in the pair (see post here)

The USDCAD moved lower this week, with 4 of the 5 days making lower lows. The pace was measured - it was not a free fall, but there was an important ceiling that kept a lid on the pair and gave sellers the go ahead to keep the bearishness moving. Looking at the hourly chart below, that ceiling is the 100 hour MA (blue line in the chart below). The closest test came on Thursday, but the price has not traded above the MA since July 12th, and since June 23rd, there have only been 26 bars, over 4 separate days that closed above the MA line (and those breaks did not go too far). That spans 20 trading days and about 480 hours. On the downside, the pair stalled at the lower trend line (see picture below). The trend remains your friend in this pair, with the 100 hour MA being an barometer for a potential correction higher (move above, and the shorts may look to cover and more dip buyers may come in). On the downside, the lower trend line(s) on the chart will be eyed. Also be aware that the low from 2016 comes in at 1.2460 (June 2016). A break below that line and the headlines will read, "The loonie trades at highest level since July 2015".

The AUDUSD surget to the highest level since May 2015 this week - extending above the 2016 high of 0.7834 in the process (last week stalled just ahead of that old high). The surge above the level on Tuesday, ultimately extended to the high for the week on Thursday at 0.79878 (RBA Debelle took some of the wind out the sails at that time). The pair consolidated/corrected lower on Friday - moving below its 100 hour MA for the first time since July 10. The pair is closing right at the 100 hour MA on Friday at 0.79157 (blue line). Decision time for the pair into the new trading week. The "market" is more balanced. IF the push is to the upside, keep an eye on the underside of the broken trend line (see chart below). That line - more or less - stalled the correction into the Friday close. A move above would be more bullish. In addition to the high at 0.7978, the natural resistance at 0.8000 is joined nearby, by the 200 week MA at 0.8013. I would expect that area to be a tough nut to crack on the first test (be aware). If the price goes lower (away from the 100 hour MA - blue line in the chart below), the 38.2% of the trend move up from the July 7th low, comes in at 0.7829 and the rising 200 hour MA comes in at 0.78215. The highs from July 14 and 17 also are in that area (see yellow area in the chart below). That area will be a support target for the pair.

----------------------------------------------------------------------------------------------------

Below are the % changes of the major currencies vs each other for the day.

For the week, the USD fell against all the major currencies with the exception of the GBP (the GBPUSD fell by -0.77%). The CHF rose by 1.88% . the EUR rose by 1.68%. The JPY rose by 1.26%.