Forex news for NY trading on October 25, 2017.

- Video: What the Bank of Canada decision means for the Canadian dollar

- Trump decides against Gary Cohn as the next Fed Chair

- Crude oil futures settle at $52.18

- The GBPAUD and GBPCAD are on fire today. What do the technicals say?

- Trump says wants to protect 401K but could negotiate

- US sells $34B of 5 year notes at 2.058%

- Goldman Sachs raised their Q3 GDP to 2.6% from 2.3%

- More Poloz: Every meeting is a live meeting

- The Atlanta Fed GDPNow estimate comes in at 2.7% vs 2.7% last

- European equities ending the day in the red. A look at the markets as Europe heads for the exits.

- BOCs Wilkins: Appreciation of $C does have significant pass through effect, but transitory

- Stocks slide. Nasdaq moves down to test 200 hour MA. Bounces modestly on first test.

- Press conference begins. Comment from BOC Poloz and Wilkins

- DOE inventory data shows crude oil inventories 856K vs -3000K est.

- The probability of a BOC rate hike in December falls to 34.3 % from 44% before the rate decision

- US new home sales (annualized) for September come in at 667K vs 554K estimate

- Bank of Canada keeps rates unchanged at 1.0%. Raise GDP estimates but sees inflation lagging due to high C$

- Morgan Stanley raises Q3 GDP tracking est. to 3.8% vs 3.4% last

- Barclays raises GDP estimate for 3Q to 2.5% from 2.3%

- US FHFA House price index for August 0.7% vs 0.4% estimate

- US Treas. Sec. Mnuchin: Very excited with progress on tax reform

- US durable good orders for Sept. 2.2% vs 1.0% estimate

- The GBP soars on better GDP, while AUD tumbles after weaker CPI

- US MBA mortgage applications w-e 20 Oct -4.6% vs 3.6% prev

- ForexLive morning news wrap: Perky pound again after decent GDP data. Yen and swiss franc weaker again.

In other markets today a near end of day snapshot is showing:

- Spot gold higher by $1.50 or 0.1%

- WTI crude oil futures are trading down $.25 or -0.8% at $52.22

- US treasury yields are up on the day off the highs. Two-year yield 1.595%, up 1.4 basis points. Five-year yield 2.047%, up 0.4 basis points. 10 year yield 2.4317%, 1.3 basis points . 30 year 2.942%, up 0.9 basis points. The benchmark 10 year yield rose to a high today of 2.4736%. That was the highest level March 2017 but the momentum higher could not be sustained

- US stocks are ending the day with losses in the major indices. The S&P index is down -11.98 points or -0.47%. The NASDAQ composite index is down -34.54 points or -0.52%. The Dow industrial average is down -112 points or -0.48%

The North American session started with durable goods orders for September which rose by a larger than expected 2.2% (1% estimate). Moreover, the pieces of the release were also better than expectations including ex-transportation up 0.7% versus 0.5% estimate. The Capital good orders nondefense ex-air aas up 1.3% versus 0.3% estimate. Prior month data was revised higher as well.

The data led to a number of GDP estimates for the third quarter to be revised higher. A key release later in the week will be third-quarter GDP. The estimate is for a 2.5% gain currently. With the revisions today I would expect the market is thinking something higher (say 2.7%-3.0%). That release will be at 8:30 AM ET/1230 GMT on Friday.

Also out today was US new home sales which came in at a annualized sales pace of 667K (highest since October 2007). That was well above the 554K estimate (for the month it was up 18.9%). The gains might have been hurricane induced but they were across all four regions indicating strong demand for new housing. The supply of homes on the market is also very low. The months supply of homes came in at 5 months. That is equal to the lowest level this year and the lower level since July 2016. The median sale price rose to 319,000 from 304,000 the prior month, while the mean sales price rose to 385,000 from 364,000 the prior month. Good news in housing.

That data was all fine and good, but it was the BOC statement and presser that was the big event of the day (Did you see Adam talking about it on the Canada Business news? Click here). The BOC kept rates unchanged after raising the prior two meetings, but the comments were full of excuses why not to raise any more in 2017 and perhaps well into 2018.

- Inflation is expected to stay below 2% until the 2H of 2018.

- The high C$ was slowing down the economy and inflation.

- The NAFTA uncertainty (which is not expected to be wrapped up until 1Q of 2018 if lucky) and a

- stronger 1H of 2017 which should slow growth going forward,

were some of the excuses expressed by Poloz and Wilkins. They did say they were dependent on the releases and all meeting should be considered "live" but will the market believe them? HMMMMM. Well today, the USDCAD price rose about 130 pips (CAD bearish), and all of the CAD crosses had CAD dollar weak price action.

While the CAD was racing lower, the GBP was racing to the upside. It was clearly the strongest currency of the day. The catalyst for the pound was a stronger UK GDP released in the London morning session. In the NY session, the GBPUSD had more of an up and down time of it - trading in a 50 pip up and down range (between 1.3220 and 1.3270. However, the gains were maintained. The 50% of the month's trading range comes in at 1.3212 and that level was respected in the NY session on two quick tests down to 1.3220 area.

The EURUSD was able to extend above its 100 hour MA, 100 bar MA on the 4-hour chart at 1.1780, and then the 200 hour MA at 1.1784 (that area is now risk for longs in the new trading day). The move higher reached 1.1817 before consolidating in the NY afternoon session between 1.1800 and 1.1817. The ECB will meet tomorrow and are expected to announce QE tapering. The rally today took the price above the midpoint of the narrow month trading range (1.1775 is the midpoint of the range), but key resistance a the 1.1837 remains as a key hurdle to get to and through (see post here).

The USDJPY held near support at the 200 hour MA at 113.57 currently. A move below is needed to turn the tide more negative.

The AUDUSD wandered down to the 200 day MA at 0.7692 (the low reached 0.76896). A move below that key MA level will be eyed in the new trading day. ON a rally the 0.77326 (low from Oct 5) will be eyed as close resistance.

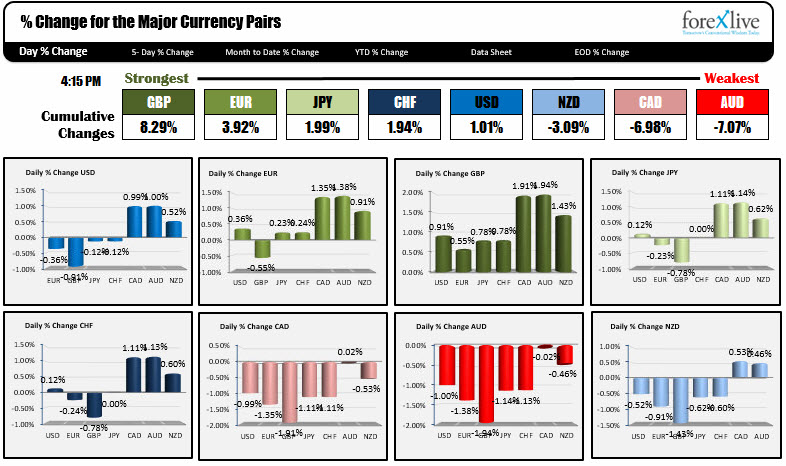

Below are the % changes of the major currencies vs each other. GBP ran away with being the strongest while the AUD ran away with being the weakest.

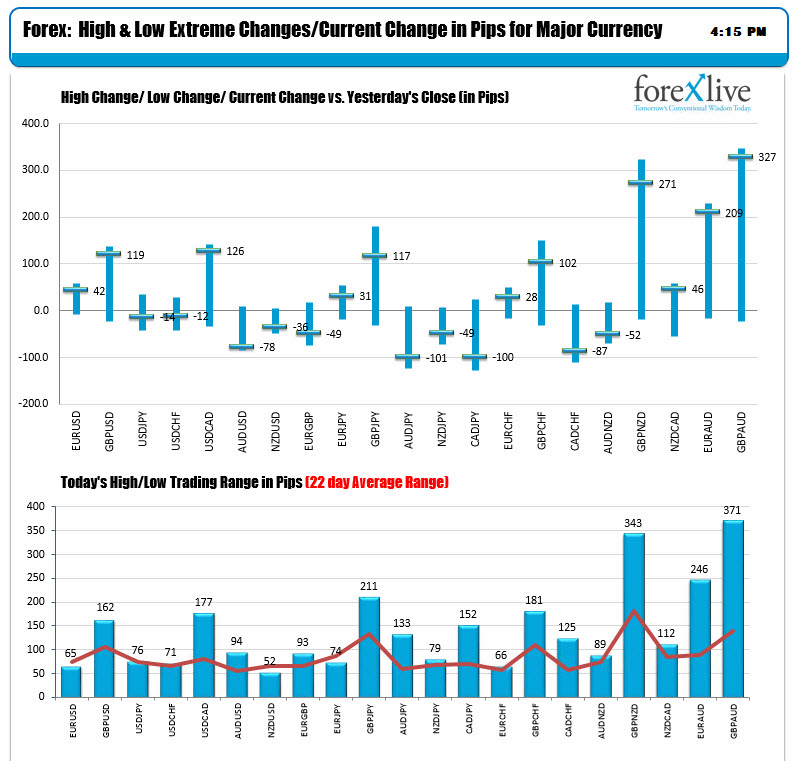

The changes and ranges are outlined in the charts below. Good fortune with your trading.