Forex news for NY trading on October 31, 2017.

- NYC incident. 6 people die. Up to 15 injured. NYPD treating it as potential act

- More Poloz: Household debt or top of BOCs mind

- Nasdaq closes at a record close. All major indices higher.

- BOC Poloz gives opening statement to House of Commons Standing committee on Finance

- New Zealand employment report due today - more previews

- US crude oil futures settle at $54.38 per barrel

- Fed decision tomorrow (along with some key earnings after the close). No change expected.

- European stocks ending the day with gains

- Forex technical analysis: AUDUSD finds seller near 200 day MA line today

- Poloz will testify at Parliament today as he faces critics on all sides

- Trump asked if corporate tax cut will be phased in. "Hopefully not"

- Bitcoin technical analysis: Breaks above topside trend line

- Dallas Fed service sector index of general business activity 18.6 vs 12.4 last month

- CME to launch Bitcoin futures before year-end. Is it good or bad for prices?

- October US Conference Board consumer confidence 125.9 vs 121.3 expected

- October Chicago PMI 66.2 vs 61.0 expected

- Scary charts: Halloween edition

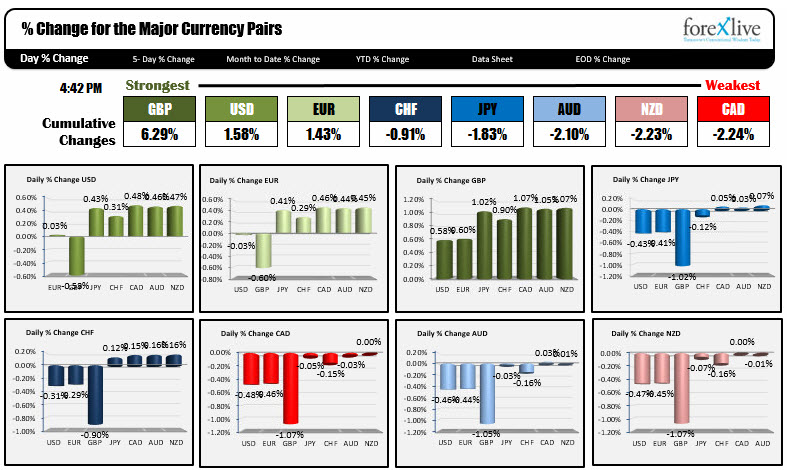

- A snapshot of the strongest and weakest show GBP is the strongest. AUD is the weakest

- USD/CAD threatens a fresh three-month high after GDP data

- UK government working on detailed delivery times for all areas of Brexit

- US Q3 employment cost index 0.7% vs 0.7% exp

- August Canada GDP -0.1% vs +0.1% m/m expected

- Spanish constitutional court cancels Catalonia's independence declaration

- ForexLive morning news wrap: Nothing too scary as month-end fails to cast its spell, yet.

In other markets, the closing levels at the end of the trading day are showing:

- Spot Gold down $5.16 or -0.41% at $1271.16

- WTI crude oil futures up $.49 or +0.92% at $54.65

- US yields are little higher. Two-year 1.5997%, +2.6 basis points. Five-year 2.0165%, +2.1 basis points. 10 year 2.3793%, plus one basis point. 30 year 2.8794%, unchanged

- US stocks are ending higher. S&P index up 2.43 points or 0.09%. NASDAQ composite index of 28.705 points or +0.43%. Dow industrial average of 28.5.0 +0.12%.

The biggest mover in trading today was the GBP. The market is focused on the BOE meeting on Thursday (and ignoring Brexit battles) where the central bank is expected to raise rates by 0.25% to 0.50%. The BOE cut rates to 0.25% in August 2016. This would be the first change since that cut.

The GBPUSD is closing nearer the highs and looks toward the next target at the 200 bar MA on the 4-hour chart at 1.32955.

The EURGBP also saw GBP strength (moved lower in the pair). The pair is moving closer to the key 200 day MA at 0.87566. The price has not traded below the 200 day MA in that pair since May 19th.

Overall, GBPJPY (+1.02%), GBPCAD (+1.07%), GBPAUD (+1.05%) and GBPNZD (+1.07%) all gained over 1%. In fact the GBPUSD and the EURGBP were the laggards at +0.58% and +0.60% for the pounds gain (see chart above).

The commodity currencies remain under pressure.

The NZDUSD is trading near the double bottom low for the year at 0.6817. The NZ employment report will be released early in the new trading day (For preview click here. For technical levels to eye, click here).

The AUDUSD remains below the 200 day MA at 0.7695 for the 4th consecutive day. The high did get a few pips above the MA level but quickly reversed lower (see post here). The 50% fo the move up form the December low is key support at 0.76429. If that level is broken we should see more selling going forward.

The USDCAD held support against its 100 hour MA and trend line in the London/NA session. Then GDP came out weaker than expectations at -0.1% vs +0.1%. That sent the pair higher where it stalled just short (a pip or so) ahead of the Friday high at 1.2916. The correction off the high was limited, but the double top is in place now. A move above will be eyed by the bulls. On the downside the trend line at 1.2856 and the 100 hour MA at 1.2839 (both are rising) are targets to get to and through if the upside run is to start to come to an end.

The EURUSD had a very narrow trading range but was able to still stay below key resistance starting at 1.1668 (200 week MA) . The 100 day MA is higher in the new day at 1.1692. The neckline of the head and shoulder broke on Thursday of last week around the 200 week MA level. A move back above would not be welcomed by shorts. Key area. (see post here).

US data was pretty good today:

- US employment cost index rose 0.7% as expected for the 3Q

- S&P Case Schiller home price index came in as expected at 5.92% gain

- Chicago PMI surged to 66.2 from 60.0

- Conference board consumer confidence came in at 125.9 vs 121.3 last

Bitcoin rose to another record level. The CME said there will be Bitcoin futures pending approval by regulatory bodies.

Late in the day the API private data showed greater than expected drawdowns. Crude oil traded to session highs at 54.85.

Also late in the day, there was a terror event when man in his 30's ran a truck down a bike and pedestrian path killing 8 and wounding 15. Prayers to the victims and the families and friends.

Tomorrow the US will release ADP employment numbers. Also the Fed will announce they will keep rates unchanged. The December hike is still expected though.