Forex news for North American trading on August 4, 2017

- US stocks end the session with modest gains. Dow has 8 straight record closes

- CFTC Commitments of Traders. EUR and JPY positions trimmed. CAD longs highest since Jan. 2013.

- Can the stocks remain strong if the dollar turns around?

- What a difference a report can make...

- Baker Hughes US oil rig count 765 vs 766 prior

- NY Fed is on the opposite side of the Atlanta Fed on Q3 GDP

- Limited downside from here for GBP - Credit Agricole

- Score a victory for the US dollar

- Atlanta Fed Q3 GDPNow forecast cut to 3.7% from 4.0%

- Dallas Fed trimmed mean 1.3% vs 1.6% prior

- Talk from Cohn helps the dollar to fresh highs

- Canada Ivey PMI (seasonally adjusted) 60.0 vs 61.6 prior

- Reactions to the July US non-farm payrolls report

- The jobs data was good, but can the US dollar hold its gains?

- Canada July net change in employment 10.9K vs 12.5K estimate

- US June trade balance USD -43.6bln vs -44.5bln exp

- July non-farm payrolls +209K vs +180K expected

- Not a heck of a lot going on into the US employment report

A snapshot of other markets shows:

- Spot gold down -$9.46 or -0.75% to $1259.00

- WTI crude oil up $0.50 or 1.02% to $49.52

- US yields are ending the day higher: 2 year 1.3509, up 1.2 bp. 5 year 1.8157%, up 2.8 bp. 10 year 2.262%, up 4 bp. 30 year 2.8413%, up 4.4 bp

- US stocks ending the session with modest gains: S&P up 4.67 points or 0.19%. Nasdaq up 11.22 points or 0.18%. Dow closed with the 8th straight record close at 2292.81, up 66.71 points or +0.30%

The price action was quiet coming into the NY session as the market awaited the US employment report. The report initially sent the dollar higher as

- non farm payrolls rose by a solid 209k vs an estimate of 180K.

- The employment rate dipped to the recent May low of 4.3% (after a move to 4.4% last month). The 4.3% rate is the lowest since February 2001.

- Average hourly earnings rose by 0.3% (est 0.3%) and 2.5% YoY (higher than the 2.4% estimate).

After some up and down liquidity volatility after the report was released (or lack of liquidity I should say), the upside trend in the dollar started to take hold.

The move higher in the dollar was helped by comments from White House advisor Cohn, who said the President's tax plan has incentives for companies to repatriate corporate cash, and that the number one priority was taxes. With the job picture painting a GDP up toward 2.5% vs 2.0% in Q1, the market loves fiscal stimulus talk that has dollars moving back to the US to be put to work back in the US. Whether it happens or not is not what it is about with the Trump administration. It is more about the story That story came out around the 10 AM ET/1400 GMT time and the greenback reached its zenith between 10 and 10:30 AM. The rest of the day was spent correcting some of gains.

In other news today:

- US trader data showed a smaller deficit of -43.6B vs -44.5B. That should be supportive to GDP

- In Canada, job gains came in at 10.9K vs 12.5K estimate but the unemployment rate fell to 6.3%, the lowest since 2008. Later the Ivey PMI came in at 60.0 vs 61.6. The near expected data was not enough to cancel the bullish story for the USD. So the USDCAD moved higher (weaker CAD). The USDCAD traded to the highest level since July 18th (high reached 1.2667).

- Estimates for 3Q GDP from Atlanta and New York Feds diverged. Atlanta has GDP at 3.7% (down from 4.0% earlier this wee). The NY Fed move up to 2.0% from 1.9% last week. A reader suggested splitting the difference. That comes at 2.85%. Still not bad compared to recent trends.

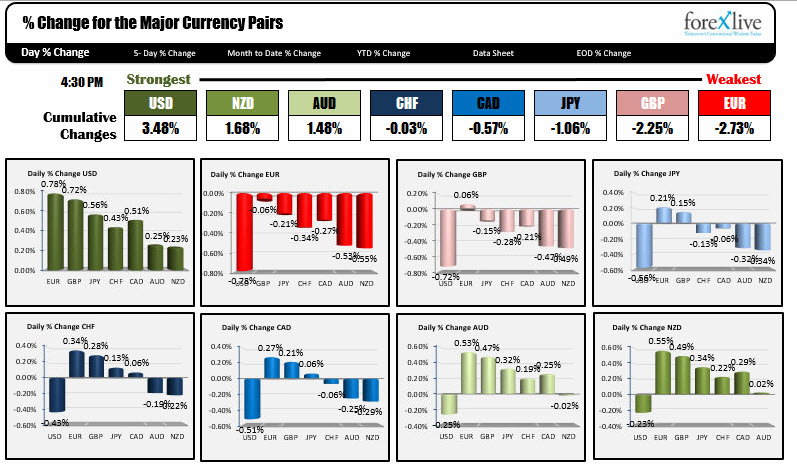

Overall, the dollar was king today - rising the most against the EUR and GBP (up 0.78% and 0.75% respectively, and the least against the NZD and AUD (+0.23% and 0.25%). The EURUSD and the GBPUSD were the dogs today.

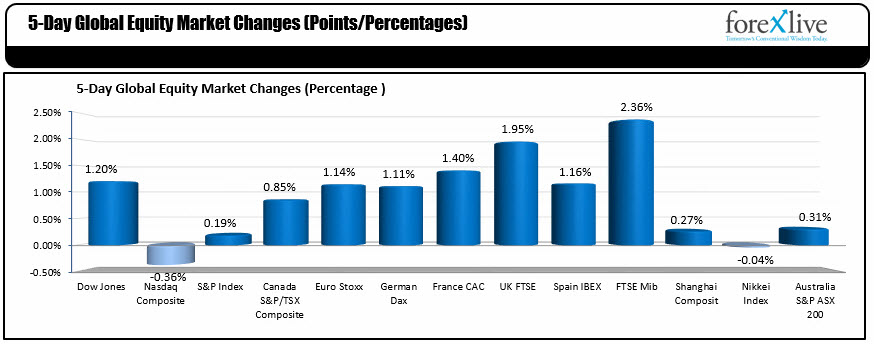

The falls in the EUR and GBP currencies were cheered by their stock markets which posted the best gains for the global stock markets. While the S&P eked out a 0.19% gain, and the tech heavy Nasdaq fell -0.36%, the German Dax was up 1.11%, the French CAC was up 1.4%, the UK FTSE was up 1.95%. Not bad. Maybe....just maybe... there will be a rotation out of the dollar and out the US stocks, and into the European stocks. Those may be themes that the market will be focuses on next week after today's/this weeks action.

Have a great weekend.