Forex news for NY traders on February 5, 2018

- CRASH! Dow down -1175 points. S&P steepest decline since August 2011.

- The drop in the S&P 500 was the biggest fall since August 2011. Here's what happened then

- Economic calendar due from Asia today – Reserve Bank of Australia meeting

- GBP/JPY is the big loser today, but it's near support

- A little flight into CHF, but not much. Gold not really running either.

- This is a something akin to a crash now

- VIX hits 30. S&P 500 down 96 points

- All eyes are on the stocks. Dollar is relatively quiet. Dow -1000 points

- Barclays trade of the week (long EURCHF) is off to a positive start

- VIX jumps 40% to the highest since June 2016 -- some perspective

- Fed's senior loan officer survey shows looser business lending standards

- More downside for Bitcoin. Trend line broken....

- North Korea said to be involved in Japanese crypto exchange hack - report

- Fed's Kashkari: Wants to see inflation and wages rise before supporting hike

- Draghi says Eurozone banks show limited appetite for digital currencies. Bitcoin falls below $7000

- Draghi admits what the QE critics claimed all along

- European stocks end the day down. Yields are lower.

- Be aware. USDCAD getting close to a key resistance target

- Powell takes the oath of office. What he really said

- ECB's Draghi: We can't yet declare victor on inflation front

- UK Brexit secretary Davis: We are leaving the customs union when we leave EU

- January US ISM non-manufacturing index 59.9 vs 56.7 expected

- US January final Markit services PMI 53.3 vs 53.3 expected

- Fed's Powell: Fed to support continued growth and price stability

- Lawrence Lindsey rules himself out of contention for Fed vice-chair post

- For the EURUSD, the bears fortunes hinges on the break of the 200 hour MA

- Germany's coalition talks reveal a desire to build comprehensive strategy on blockchain

In other markets near the US close:

- Spot gold up $5.88 or 0.44% at $1339.06. Given the huge fall, the rise was

- WTI crude oil futures fell $-1.82 or -2.70% and $63.63

- Bitcoin is trading at $7175 down $890 on the day. The bellwether digital currency is looking likely to close below its 200 day moving average for the 1st time since October 2015.

- Vix is trading at 37.32, up 20.01 or 115.60%

Stock market summaries are not pretty:

- The Dow fell 1175.21 points or -4.60%

- The S&P index fell -113.19 points or -4.10%

- The Nasdaq fell -273.419 points or -3.78%

In after-hours trading the S&P ETF is trading down 1.25% and the PowerShares QQQ was trading down -0.75%. So trading is continuing to be under pressure.

What about the debt market? Yields did move sharply lower on a flight into the safety of US debt.

- two-year 2.0322%, -10.9 basis points. The high-yield reached 2.1496%

- five-year 2.440%, -14.8 basis points. The high-yield reached 2.6087%.

- 10 year 2.709%, -13.1 basis point. The high yield reached 2.8831%.

- 30 year 3.006%, -8.1 basis point. The high-yield reached 3.1343%

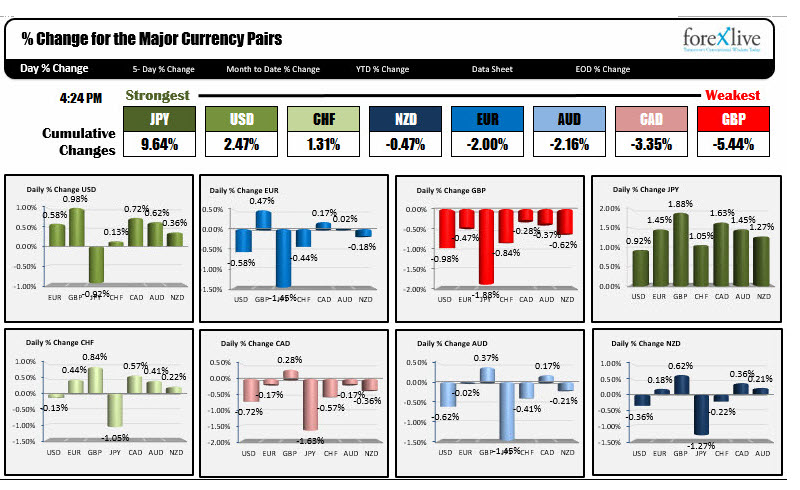

What happened in the forex market?

The Pavlovian reaction kicked in on days of large stock declines and the JPY pairs fell sharply lower.

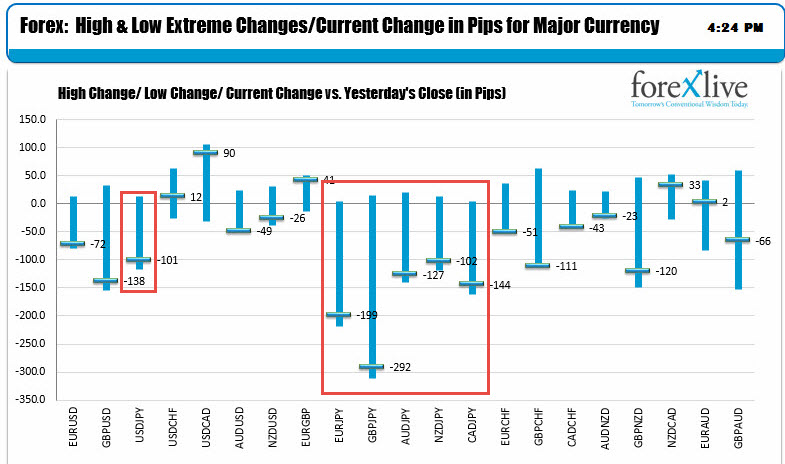

Looking at the chart above, the JPY pairs are all trading toward their lows for the day. They also had some pretty good declines. The GBPJPY is down -292 pips, The EURJPY is down -199 pips. The USDJPY is lower by -138 pips. Those are hefty declines as funds flowed into the "relative safety of the JPY" (whether that makes sense or not). That was the trend and is the typical trend when equity markets start to go ballistic.

As a result, the JPY was the run away strongest currency of the day (see chart below). The GBP - helped by a sharp -1.88% fall in the GBPJPY - is the weakest currency. The USD is ending mostly higher with gains against all the major currencies with the exception of the JPY.