Forex news for NA trading on March 9, 2017

- A new record close for the Nasdaq as stocks soar.

- CFTC commitment of traders: Positions trimmed in the current week

- WSJ: Trump lawyers seek deal with Mueller to speed end of Russian probe

- Trump/Xi welcome prospects of dialogue between US and North Korea - WH

- Crude oil futures are ending the week at $62.04/BBL

- We haven't had one of these in a while...

- Martin Shkreli sentenced to 7 years in jail

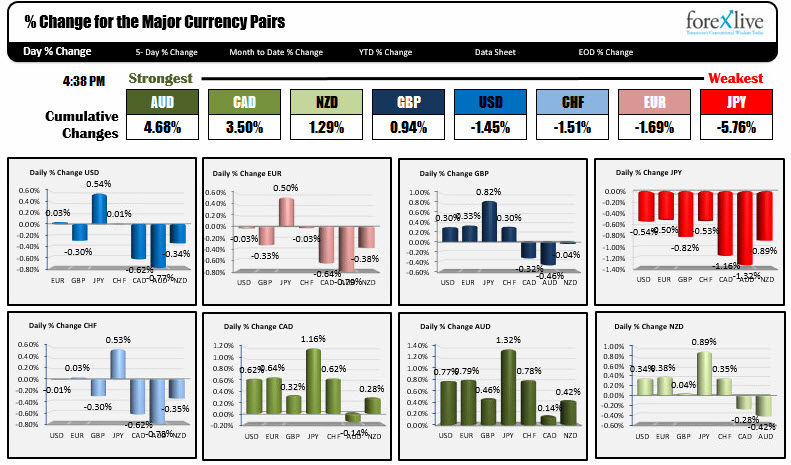

- The Australian dollar was the best performer this week

- BEWARE. Bitcoin threatens to close below it's 200 day MA today

- Baker Hughes total oil rig count 984 vs. 981 last week

- More Evans. Speaking in NY City after making rounds on business news earlier.

- Fed's Rosengren: Suggest four US rate hikes likely needed this year

- European close: Modest gains to cap a strong week

- Atlanta Fed GDPNow 1Q 2.5% vs. 2.8% last

- Goldman Sachs CEO Lloyd Blankfein could leave at year-end

- Inside the battle for tariffs in the White House

- NY Fed GDP Nowcast 1Q 2.8% vs. 3.0% last week

- ECB staff offered scenario with mid-2019 rate rise - sources

- Sen Cornyn: Trump asked him what would happen if he issued NAFTA termination

- Fed's Evans: Wage growth was a little on the weak side

- Back to the trade war: Mnuchin says he's talking to Congress about reciprocal taxes

- US January final wholesale inventories +0.8% vs +0.7% expected

- China's Xi says he appreciates Trump's desire to resolve North Korea issue peacefully

- NAFTA exit would lead to year-long recession in Canada - Conference Board

- Odds of another Fed hike in June rose after non-farm payrolls

- Fed's Evans: Labor market not seeing wage pressures yet

- Strong jobs but wages lag has the dollar moving higher at first, but not for long

- Canada Feb net change in employment 15.4 k vs 21.0k exp

- February non-farm payrolls 313K vs 205K expected

- The CAD is the strongest and the JPY is the weakest before the US employment report

A snapshot of other markets are showing:

- Spot gold up $1.19 or 0.09% at $1323.33

- WTI crude oil is trading up $1.97 at $62.09

- Bitcoin slumped again today, but looks to be averting a close below its 200 day MA at $8971. It is trading down -$270 at $9066 after trading as low as $8370.

The US jobs data was released and it showed stronger than expected job growth of 313K. That was the good news. The not so good/mixed news was that the unemployment rate ticked higher to 4.1% from 4.0% (but it is still at just 4.1%), the participation rate increase to 63.0% from 62.7% as more people re-entered the workforce (that is not bad news for the economy), and hourly earnings only rose by 0.1% MoM and 2.6% YoY (do we really want run away wage growth/inflation anyway. Slow and steady is still ok).

The results were that yields moved higher on the back of the expectation that 4 hikes is getting more and more likely. However, the pace - because of the wages and rise in the participation rate - is still likely to be gradual.

Moreover, the market seems to be comfortable with the 4-hike idea, as stocks soared across the board. The major indices each closed the day with gains of >1.74%, with the Nasdaq closing at a record level. Also, if you rounded up, the Nasdaq is up 10% on the year. Wow! And to think this week included tariffs on steel and aluminum being enacted - albeit on a watered down basis.

Happy days are here again.

As mentioned, yields moved higher,

- 2-year 2.58%, +0.8 basis points

- 5 year 2.65%, up 2.0 basis points

- 10 year 2.894%, up 3.6 basis points

- 30 year 3.159%, up 3.8 basis points

However, the gains were measured, and the yields are ending off the highs.

In the forex market, the theme for the day was risk-on. That helped to send the AUD and the CAD to the top of the major currency "league table". Those currencies outperformed to the upside. In Canada, their employment data was also released, and was less than stellar. Job gains same in at 15.4K vs 21.0K estimate with the full time component falling and the part time rising. Nevertheless, the risk-on flows, coupled with follow through buying from the US tariff exemption yesterday (and perhaps hope of a NAFTA agreement), kept the CAD supported.

The loser for the day was the JPY as traders flowed back out of the "relative safety of the JPY" trades.

After it was all said and done the USD is ending the session lower - owed largely to the commodity (risk-on) currencies. The greenback did also fall vs the GBP (by -0.30%), rose against the JPY and was unchanged vs the EUR and the CHF.

A couple weeks ago, the idea of 4 tightenings would have had the market really worried, but the Goldilocks employment number today certainly has the market accepting of that number. Now, only if the US can avoid a trade war with rest of the world, then perhaps the world economic growth can keep the momentum going.

Wishing all a happy and healthy weekend and thank you for your continued support.