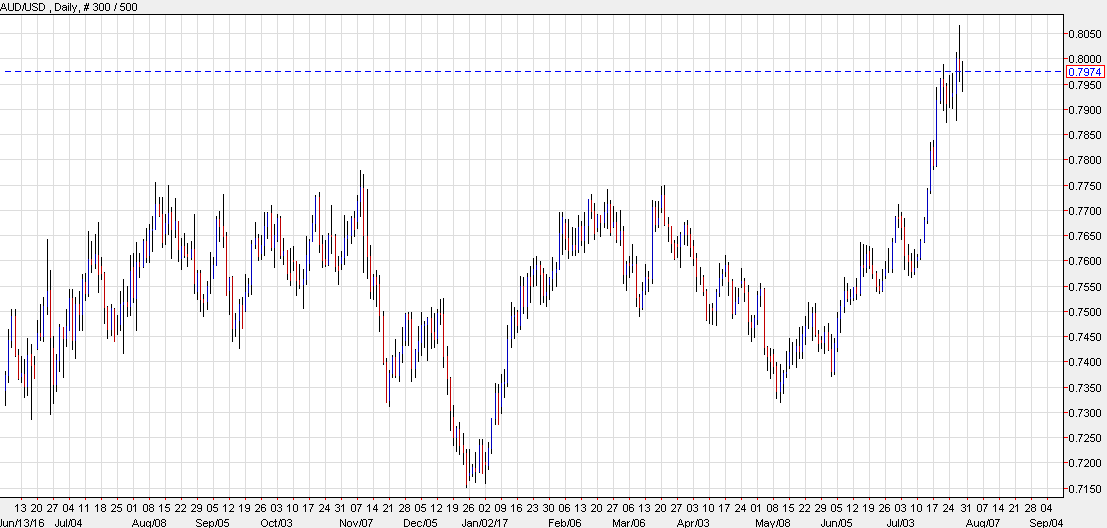

RBA hike expectations overdone

Goldman Sachs Asia-Pacific head of fixed income Philip Moffitt says the RBA isn't going to be as hawkish as the market expects and that it's time to think about selling AUD more broadly and against the US dollar.

"It's an opportunity to be selling Aussie," he told Bloomberg. "But the hard part of doing that trade is the Aussie side looks reasonably straightforward; the U.S. side is not as straightforward."

More broadly, Goldman Sachs is looking to add to bets on the US dollar and higher Treasury yields. They expect the Fed to hike rates faster than the consensus.

"We wouldn't be giving up on a strong dollar and we wouldn't expect bond yields to stay as low as they are," Moffitt said. "Inflation will slowly rise and the Fed will be quite aggressive in rate hikes."

On the Australian dollar, they say that the recent rally in the currency will keep the RBA sidelined and if it rises any further, they may even consider lowering rates.