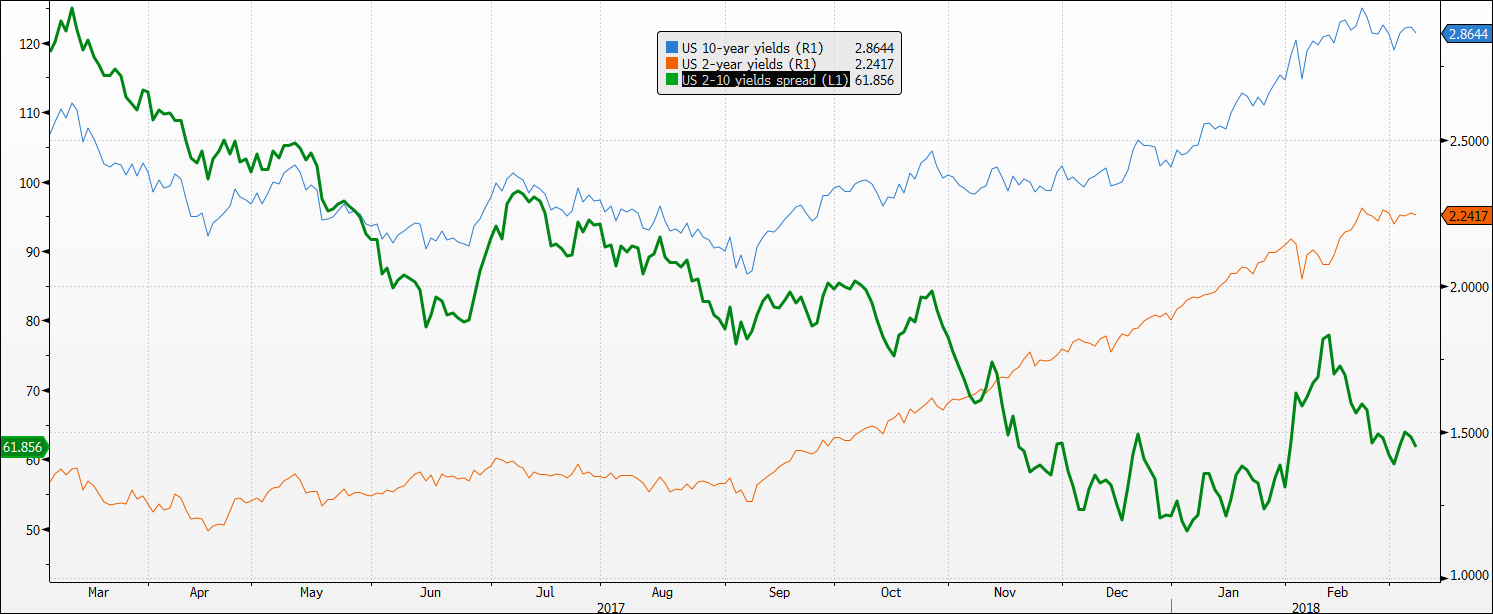

The bank expects higher inflation prints in the coming months ahead will promote a steeper US yield curve and push up rate volatility

- US Treasury yields are broadly pricing in stronger GDP growth resulting in a higher and more uncertain path for short real rates set by the Fed

- The market view on medium-term trajectory of US inflation remains benign

- Markets are pricing it close to remain close to the Fed's 2% target over the medium-term

- Base case in that higher inflation will promote a steepening in the yield curve

- Uncertainties on where real policy rates are heading will persist

- And such uncertainties compounded with inflationary pressures will lead to increase in inflation risk premium

- And that dynamic will result in a steeper yield curve and a more sustained increase in long-dated interest rate volatility

Some market commentary by analysts from Goldman Sachs on US Treasury yields. A lot of their forecast here hinges on the fact that we will see inflation rise towards 2% or higher in the US, but for the time being there's still not much to suggest that such a rise will be sustainable.

The market will get another taste of inflationary pressures on Friday, when the US non-farm payrolls report is set to be released. The key once again, will be to watch out for wages growth (average hourly earnings). The January report released last month saw wages grew more than expected, and it pretty much wrecked the stock market and pushed up Treasury yields at the same time.