ArticleBody

A preview of JOLTS job openings and the February industrial production figures coming up 16 March 2018

Industrial production due at 1315GMT

JOLTS job openings at 1400GMT

February industrial production (this via Capital Economics)

We estimate ... strong gains in manufacturing and mining.

February report could be unusually noisy, with all three main categories of output seeing big moves

- Record-warm temperatures across much of the East coast last month appear to have hit utilities output, and the electivity generation figures point to a potentially sharp slump.

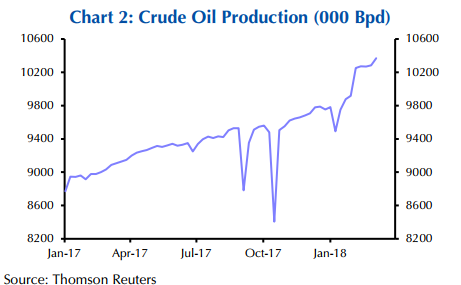

- Meanwhile, after a 1% m/m drop in mining output in January, which appeared to be partly related to the unseasonably cold conditions early that month, the more recent surge in weekly crude oil production to a record high points to a rebound in mining output of as much as 4% in February.

- Manufacturing output has been subdued over the past couple of months following rapid growth at the end of last year. Given the continued strength of the business surveys and the reported jump in employee hours worked in February, however, we have pencilled in a stronger 0.6% m/m gain.

On the Job Openings and Labor Turnover Survey (JOLTS) .... this via Nomura:

- Job openings softened somewhat in Q4 2017, declining 366k after reaching a post-crisis peak of 6177k in September, with professional & business services accounting for roughly 60% of the drop.

- With a tightening labor market and strong growth this year, we expect job openings to remain elevated over the medium term.

- The quits rate increased 0.1pp to 2.2% in December, within the narrow 2.1-2.2% since May 2016. Labor market turnover, the sum of hires and separations as a percent of two times employment, remained unchanged in December at 4.0%, still well-below the 2005 and 2001 peaks of 4.5% and 5.0%, respectively.

ps. There is other data due also - University of Michigan consumer confidence, housing starts .... I'll post on these separately later.