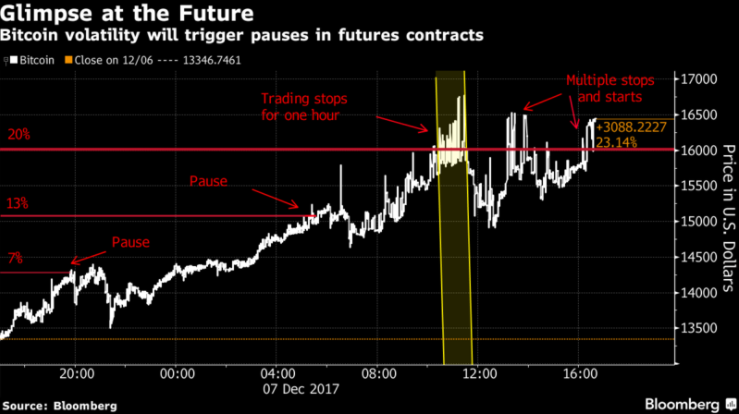

Here's how it may end up trading based on yesterday's movement

The CBOE and CME are due to roll out futures contracts for Bitcoin on 10 December and 18 December respectively. As for Bitcoin itself, we saw it blow past the $14,000, $15,000, and $16,000 levels all in one day. And it's more than a 40% jump in over 48 hours.

With regards to futures trading, things could be very, very start-and-stop.

Bloomberg's article here highlights that CME stipulates trading halts for 2 minutes if prices rise/fall by 7% from the prior day's settlement price. And another 2 minutes pause if it widens to 13%. And that no trades can occur at prices beyond 20% from the settlement.

Meanwhile, CBOE trading will halt for 2 minutes if prices rise/fall by 10%, and for 5 minutes if it hits 20%.

It'll certainly be interesting to see how things go and if the CME or CBOE are flexible enough to make special exceptions for Bitcoin.