HSBC on the Australian dollar and the RBA minutes (December meeting, out yesterday)

- The RBA minutes ran through the usual laundry list of factors affecting the economy, concluding that policy inaction for now is appropriate.

- The mix of factors allowed the Sydney Morning Herald to cite the "significant risk" that the RBA sees around weak consumer spending, whereas Bloomberg reported that Australian bonds were lower after the minutes signalled "confidence" that unemployment would fall and inflation would climb.

- The AUD was little changed given the myriad of factors supported patience on the policy front.

- The key pinch point likely remains wages growth. If this picks up, the RBA can pivot towards the exit on rates (HSBC looks for a hike in Q2 18). If not, then we can expect the current patient stance to be extended.

That's from an overnight note from the bank (bolding mine).

HSBC hitting the nail on the head here (mixed metaphors mine also). We've been going on and on about slow wage growth for months now. The point is its impact on consumer spending (it serves to keep it restrained) and thus economic growth. Especially when combined with high levels of household debt ... money going to service dent is not sopent on discretionary items.

--

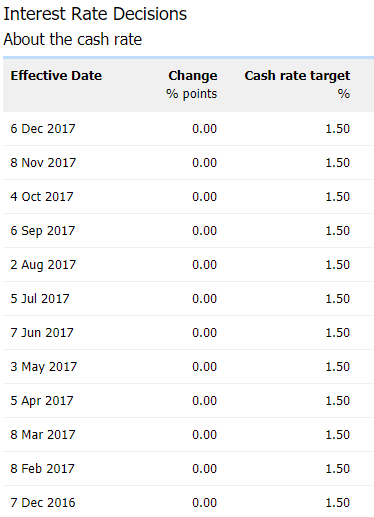

its been a torrid year for the Reserve Bank of Australia .... not:

;-)

The last change (quarter percentage point cut) to the cash rate was at the August 2016 meeting.