ING argues that a surge in US oil exports may spell the doom for OPEC's production cuts

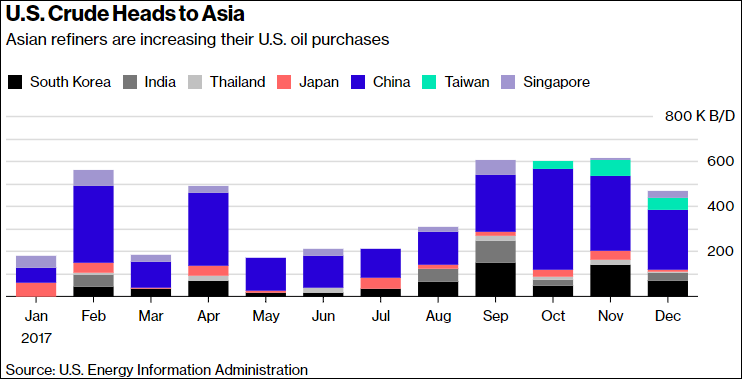

According to Warren Patterson, a commodities strategist at the firm, a surge in US shipments to Asia threatens to undermine the production cut deal between OPEC and its allies - and that puts oil at risk of heading back below $60.

Patterson argues that once US flows start gaining a bigger slice of the "prized Asian market", it may prompt some nations to boost supplies as well.

"The longer the deal goes on, it's going to start falling apart", he says. ING forecasts that Brent oil will fall to $57 in the second half of the year.

Despite all that is said about the production cuts, over the years OPEC and its members are very defiant on one thing - and that is maintaining market share, and if the threat of the US becomes large enough it really wouldn't be a surprise to see some scuffle and breach of compliance in the current production cut deal.

It was one of the reasons why the OPEC deal was so difficult to be struck when negotiations were taking place in the past and also why countries still tried to skim on said production cuts even though they were already part of the deal.

ING's forecast is a bit of a contrarian view to what other financial institutions are forecasting over the last few weeks. Here are views from SocGen and BofAML on oil this year.