A note published by Barclays overnight on yen flows in February, some of the highlights:

(bolding mine)

Japanese investors turned net sellers of foreign equities for the first time in 11 months amid the global equity rout

- also switching to net sellers in foreign bonds in line with the rise in overseas yields

- They resumed buying of foreign bonds in early March after substantial sales in February as US Treasury markets began to show signs of stabilization

Institutional and individual investors bought large amounts of Japanese equities amid sharp corrections in the Nikkei.

- In contrast, sales by foreigners reached their highest level since March 2016

JGB transactions slightly undershot the FY17 average, but activity was brisk among some investors.

- Life insurers became the biggest buyers of JGBs as expectations for prolonged YCC strengthened

Net issuance of foreign- currency-denominated uridashi bonds remained in negative territory for the sixth consecutive month, while Toshin FX-overlay exposure increased for the 15th consecutive month.

---

On yen:

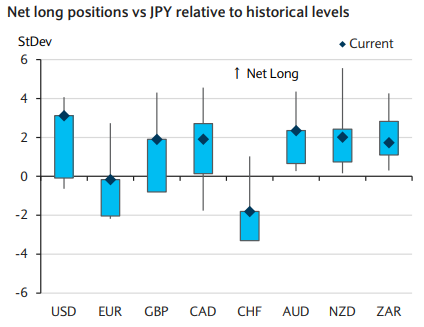

Total net long positions in the seven major currencies versus JPY continued to increase in February amid JPY appreciation, led by USD.

- In terms of the currency breakdown, net long positions in USD rose for the third consecutive month, reaching their highest level since December 2015. The increase in net USD positions likely reflects retail investors' typical contrarian trading style as USDJPY has fallen significantly since the beginning of the year.

- Investor positions in EUR and CHF stayed in net short territory, while they switched to net long GBP positions for the first time in six months.

- In other currencies, Japanese investors increased their net long NZD, AUD and CAD positions.

Weekly partial data shows that investors continued to build further long USD positions in early March amid USDJPY weakness. They also purchased large amounts of GBP and AUD.

---

And, ICYMI earlier: