What to expect for the CPI data due from Japan for February

I posted earlier on it here (expected, priors and perhaps a hint from Tokyo):

Remember, this data is due at 2330 GMT. A lot of data from Japan comes at 2350GMT, but not the inflation data, that comes 20 minutes earlier. 2330 GMT is 8.30am Japan time - up and at 'em!

Previews (quickies), via:

Barclays:

- We estimate that nationwide core inflation (y/y) strengthened slightly in February. We look for core CPI inflation to hold around 0.9-1.0% y/y through midyear, then strengthen to 1.2% y/y in August-September, marking the peak for 2018.

Nomura:

- We expect the February all Japan core CPI (ex-fresh food) inflation to rise to 1.0% y-o-y, 0.1pp stronger than the January reading. We forecast February all-Japan core core CPI (ex-energy and food, except alcoholic beverages) inflation to increase to 0.2%, and the so-called BOJ version of core core CPI (all items ex energy and fresh food) inflation to rise to 0.5% in February, both improvements of 0.1pp from January. We think accommodation and overseas package tours, for which price volatility is high, will boost the various inflation readings for February.

Capital Economics

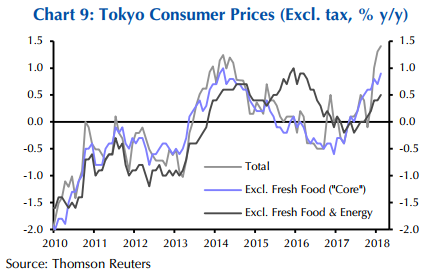

Tokyo CPI ...

(Capital Economics referring to the data I discussed earlier, at that link above)

showed that headline inflation climbed to a fresh high of 1.4% y/y in February

- Fresh food inflation remained stubbornly high as the impact of last year's typhoon and cold winter weather persisted

- And inflation excluding fresh food and energy was the highest it has been since June 2016

We expect all three main inflation gauges to creep higher in February ...

(CE on 'core-core' CPI)

... a jump in hotel charges and package tour prices should have lifted inflation excluding fresh and energy