According to a report by its Australian economics team, led by Sally Auld

The report notes that "the most important point is that the desynchronisation is not over" and their view is that it will likely persist for years to come.

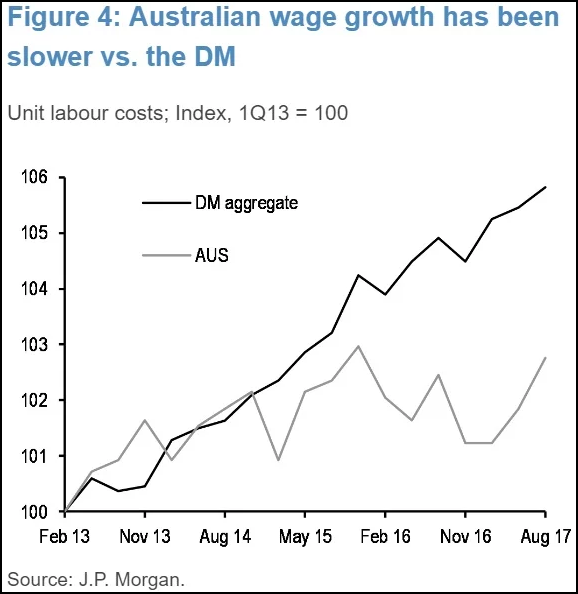

The main headwind that is dampening the economy in their view is the consumer segment. The report argues that high household debt levels and weak wage growth are the major culprits on that front, and it will limit any recovery in consumer spending.

And that has put the Australian economy in a lagging position compared to the recovery seen in other developed nations, and JP Morgan believes the trend will persist for some time to come - which is a view the RBA doesn't share as they see things in the economy improving over the next year or so.

However, the recent RBA meeting did highlight on the two issues mentioned in the report here which are high household debt and subdued wage growth. While the RBA has been taking notice, it's been an issue that is tough to resolve. It's something that I pointed out last year here.

The household debt levels issue came to the forefront in last year's Q1 GDP report when the savings ratio grew at a slower pace for four quarters running, and digging into the report back then you could see that the main drivers of household expenditure came from electricity, gas, fuel, vehicles, insurance - which are pretty much necessities.

And that says a lot about consumption patterns in the economy, as to how consumers are constrained - due to low wage growth and high household debt, which means they are reluctant or unable to increase spending levels.