US inflation data is out later at 1330 GMT - here's why it matters

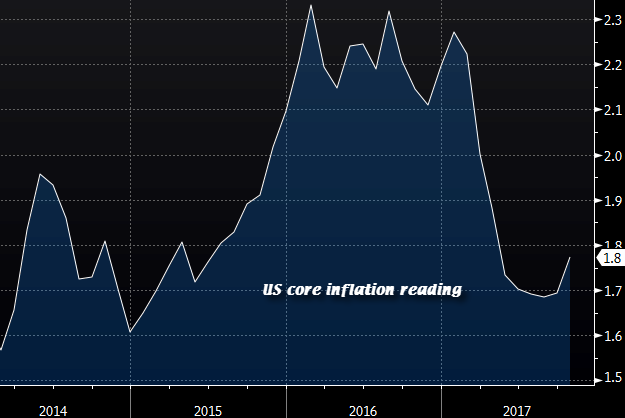

Yesterday, we got some PPI numbers here that surprised to the upside. And the market is already primed for the upside risk that inflation numbers may also come in a bit higher - though expectation for the core inflation data is to remain unchanged from the prior reading.

While the Fed is likely to already have this number ahead of the FOMC meeting, it's worth keeping tabs on the market expectation/reaction when these numbers come out later.

The Fed hiking rates later is a given at this point, but the dot plot projections is one of the key focus points. A higher inflation reading later may give the dollar a boost in the run up to the Fed meeting, but expectations of a more hawkish Fed may not materialise if the Fed sticks to the previous estimate of three rate hikes in 2018.

And that may put a wet blanket on a market that got "excited" after better inflation numbers in the build up.

Right now, the market is basically muted ahead of the Fed decision. But watch out for when after the inflation numbers are released, because that could set the tone of what the market is expecting - which will impact the reaction of the Fed meeting later.