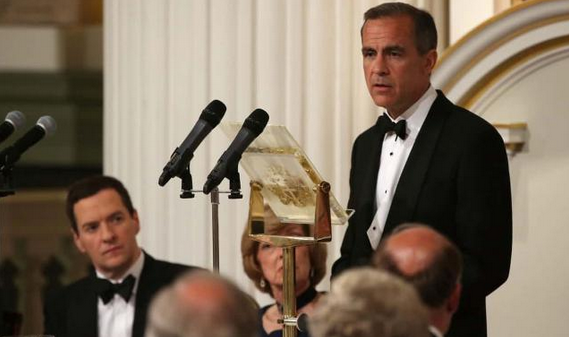

Mark Carney doesn't have any credibility to spare

On June 12, 2014 Mark Carney made his infamous Mansion House speech.

"There's already great speculation about the exact timing of the first rate hike and this decision is becoming more balanced. It could happen sooner than markets currently expect," he said.

The comments set off a wave of pound-buying but it ended in tatters after Carney later backtracked.

He didn't learn his lesson and floated hawkish comments again and again. His exaggerated warnings on Brexit were another misstep and then he took credit for stable growth in the aftermath (because he belatedly cut rates).

Suffice to say, he's had a poor term as the Governor of the Bank of England.

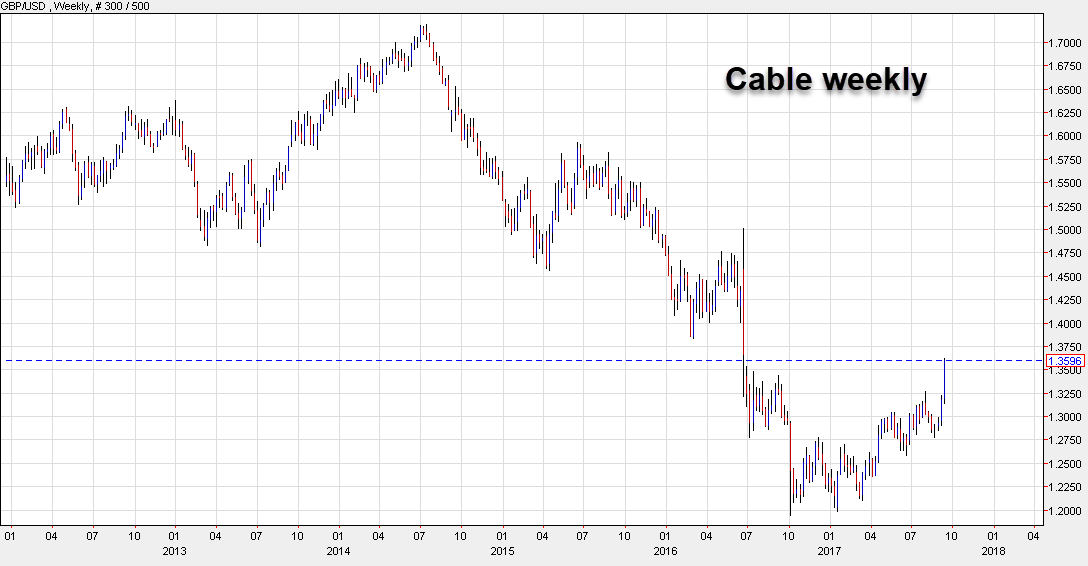

He has until June 2019 to rebuild his reputation and he started this week with yet-another warning that rate hikes are coming. Cable is up nearly 4 cents in the aftermath and the OIS market is now pricing a 65% chance of a hike at the Nov 2 meeting, rising to 73.5% in December.

If Carney doesn't hike this time his reputation will be downgraded from 'strained' to 'tatters' or worse. That alone is a good reason to bet on it happening and bet on the pound.

Questions about one-and-done are valid but those were the same questions that dogged the Bank of Canada and we've all seen how that turned out. For now, I think we have to recognize that Carney is desperate to hike, the pound is severely depressed and the market is caught short.

Sure, it would have been nice to catch the first 400 pips of this move but missing it is no reason not to catch the second 400 pips. If you want to be more patient, expect dips (high to low) to be limited to 70-100 pips.