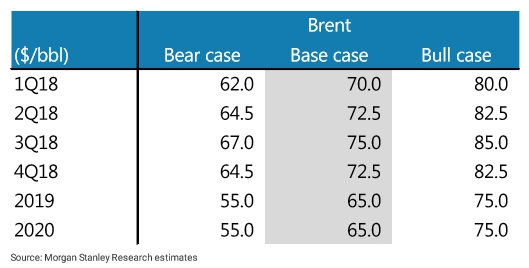

Morgan Stanley maintains their price forecast for Brent oil in 2018

- Prices will be supported by a global supply shortage

- Recent evidence shows that global demand is forcing inventory drawdowns

- Supply/demand backdrop will drive increased activity in oil futures, which should help to support prices

Some comments there by their analysts Martijn Rats and Amy Sergeant. They also noted that the global oil market will remain undersupplied by around 200k - 300k barrels per day this year, and that in turn will drive technical price action in oil futures markets that will be supportive of prices.

Brent crude is currently trading just under $63 per barrel, after peaking $70.78 on the year - a decline of more than 11% since January.

At the moment, the decline is stemmed by support at the 100-day MA (red line) level: