Via eFX comes this from National Australia Bank:

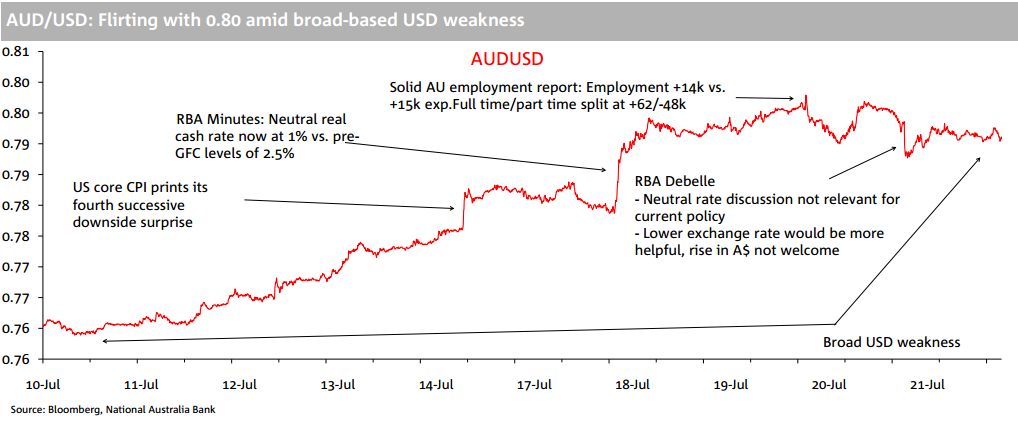

NAB FX Strategy Research argues that it continues to be of vital importance to distinguish between the influence of broader US dollar trends and idiosyncratic forces operating on the AUD.

"Until we see that ingrained US dollar bearishness has run its course, at least for now, then setbacks for AUD/USD are likely to be shallow and a move to above 80 cents hard to argue against with any conviction.

....We'd also note that while AUD/USD is now looking rich to our short term fair value (STFV) model estimate (0.7910 vs. 0.7690 STFV) this is inside the model's ' fair value range. Typically, reliable buy/sell signals only emerge when AUD/USD is about 4 cents away from STFV.," NAB adds.

"We maintain our 0.70 year-end /early 2018 forecasts for AUD/USD while acknowledging that the level from which we still expect a 5-6 cent fall into year-end is currently several cents higher than when we made the forecast," NAB argues.

--

ps. eFX didn't post the AUD chart NAB included with the note, here it is: