According to a research note by analysts at the firm, Andreas Steno Larsen and Martin Enlund

They argue that while the swissie has strengthened in trade-weighted terms since December, in real-terms it has continued to decline against the euro.

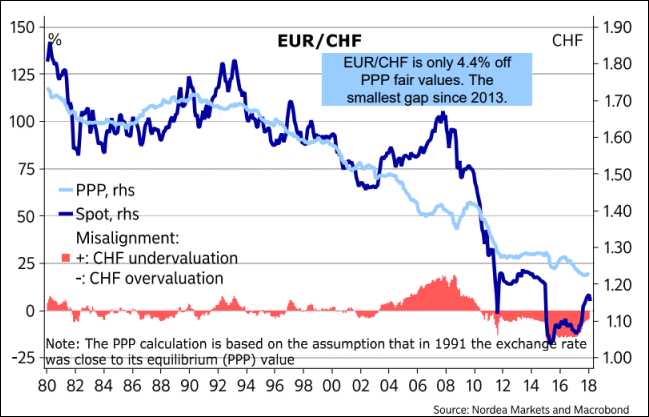

According to their estimates, the CHF is now only 4.4% overvalued against the EUR in PPP (purchasing power parity) terms - compared with the 4.85% back in December.

They add that "had the meeting been a few weeks back where EUR/CHF traded below 1.15, the SNB would probably have chosen to step up the verbal fight against a stronger CHF (note that the SNB intervened lightly in the markets against a stronger CHF in Jan/Feb) but now that the situation has calmed again, we expect very limited changes to the wording".

Based on that, the note says that the best risk reward is betting on a lower EUR/CHF over the SNB meeting and over the short-term as well.

While the pair may be set for further correction to the downside, the SNB has been rather firm in putting their foot down from letting the swissie run too far from where they'd like it to be. Mike has also pointed out several times over the last two months as well that they are having a hand in intervening with swissie pairs, so even if there is downside to run - it will be limited.