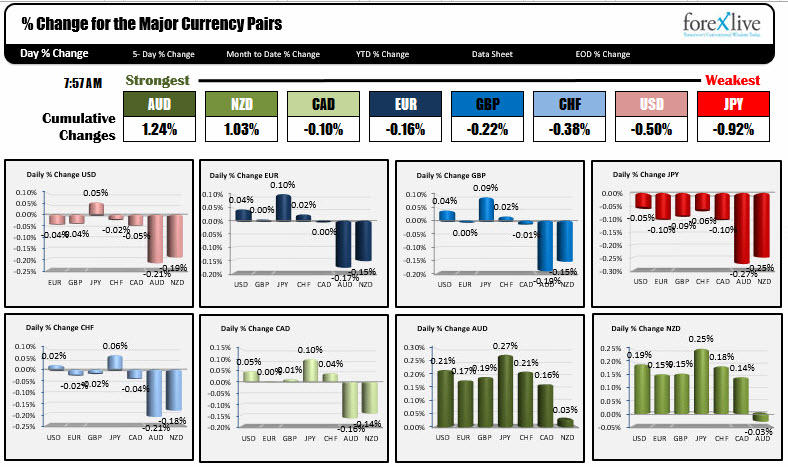

AUD the strongest. JPY the weakest.

There is not a whole lot going on before the July US employment report at the bottom of the hour. The snapshot shows that the AUD is the strongest. The Australia retail sales were a bit stronger than expectation and the RBA tried to jawbone the AUD lower, but there was a little more buying vs selling. The JPY is the weakest. Strongest or weakest...it does not really matter that much as any one currency to quickly rise or fall to the top or bottom of the table. All have done the same, not a lot of anything.

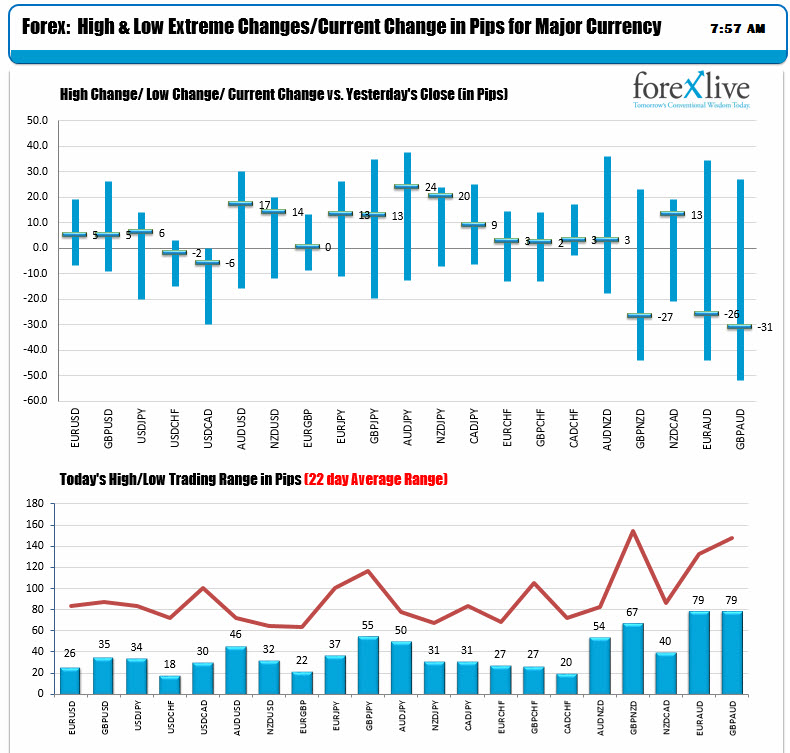

You can see that in the ranges. The major currency pairs vs the USD have very narrow trading ranges. All are well below their 22 day average trading ranges. Of course, all has the potential to change at the bottom of the hour when the US employment report will be released.

What to expect:

- NFP change 180K vs 222k last month

- Unemployment rate 4.3% vs 4.4%

- Avg hourly earnings +0.3% vs 0.2% last. YoY 2.4% vs 2.5%

- Work week 34.5 hours vs 34.5 last

By the way, Canada will also release employment statistics:

- Change in employment 12.5K vs 45.3K

- Unemployment rate 6.5% vs 6.5% last

Trade data for the US and Canada will also be released but will take a back seat to the employment data.

A snapshot of other markets before the data shows:

- Spot gold $1267.93, down -$0.60 or -0.4%

- WTI crude oil $48.92, down -$0.10

- US yields are up. 2 year up 0.8 bp. 5 year up 1.5 bp. 10 year up 1.4 bp. 30 year up 1.7 bp

- US stock futures ar up with S&P up 3.25 points. Dow futures up 35 points. and Nasdaq futures up 7.25 points.

Lots of risk at 8:30 AM ET. Be careful out there.