Fed funds market more focused on jobs than wages

The US added 313K jobs in February and revisions showed another 54K jobs added in Dec and Jan.

Ultimately, that's showing a healthy economy and it means the Fed will want to get closer to some kind of neutral rate, which is closer to 3% than the current 1.25-1.50% range.

How soon they get there is another question. One argument is to wait and see if inflation picks up; another is to have faith and move deliberately higher.

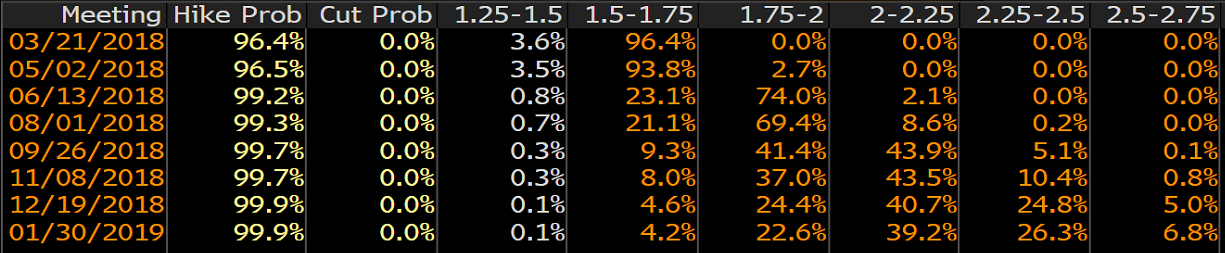

The second argument is winning out in the market. A hike on March 21 remains a slam dunk with the market pricing in a 96.4% chance. Beyond that is where it gets interesting.

One big change after this report is that the likelihood of a second hike in June rose to 74.0% from 69.8% a day ago.

Continuing with a third hike in September is on 50/50 compared to 45% before and four hikes before year-end is at about 36% from 32%.