TD Securities in their most recent Commodities Weekly, they are looking for

Continued lower-than-expected US inventory prints

less drilling activity

and supply constraints

(to) place a floor under crude oil, even as over-supply fears loom large

More:

- While finishing somewhat below week-ago levels, WTI and Brent crude oil both rebounded from the lows and found support. WTI crude continues to trend near $47.50 despite the over 2.25% decline on Monday, with Brent posting prices convincingly above $50/bbl.

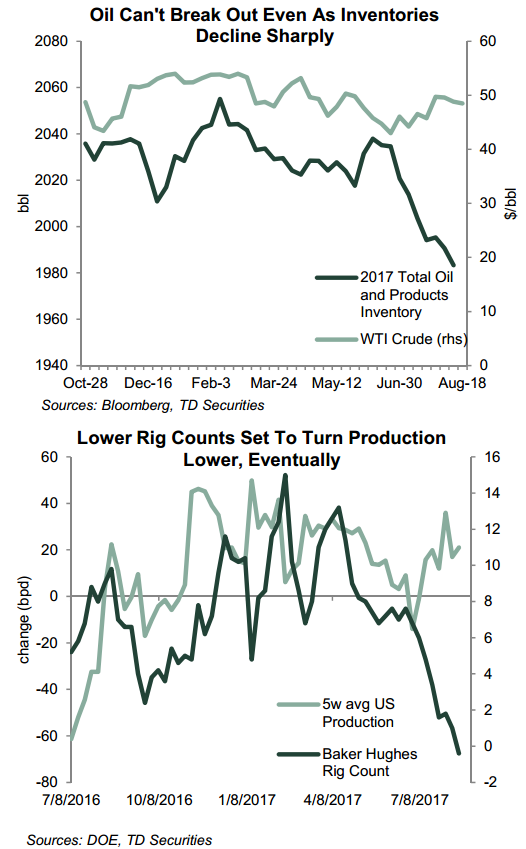

- Crude markets continue to have a difficult time breaking out higher, despite the fact that the weekly EIA numbers reported a seventh consecutive draw in crude stocks and another counter seasonal decline in total US stocks, along with another week of declines in drilling rig activity.

- The market focused on the bearish news for oil in the form of the 79,000 bbls/d US production increase and continued to react to IEA revelations that inventories are higher than previously expected.

- Plus, there is limited confidence OPEC/Russia will extend the current supply control regime beyond Q1-2018.

- Despite recent range-bound trading, we continue to see $60/bbl crude in early 2018. We expect shale output to top out after September strength and we see OPEC increasing the chatter surrounding the extension of its supply controls into 2018. This should help WTI to move into mid $50s territory late in 2017 and toward $60 next year, as inventories are drained quickly.

- Given the US shale and OPEC uncertainties, for now we expect trading to remain quite choppy and range-bound

--

The TD note was out prior to today's inventory data, which is flagging an eighth consecutive week of draws in inventory