The Bank of Japan statement is the main event (Governor Kuroda will follow with a press conference much later, 0630 GMT)

As I posted already (and do every BOJ day) there is no concrete time for the BOJ announcement and statement. Its likely in the 0230 - 0330 GMT time window.

There is no change in policy expected from the Bank today. Here is a quick preview from Barclays:

We expect the current stance to be retained by a majority vote.

This will be the last MPM attended by Deputy Governors Nakaso and Iwata. BoJ Executive-Director Amamiya and Waseda University Professor Wakatabe, nominees to succeed them ... The two hold opposing views on monetary policy (the former advocating normalization and the latter calling for more QE)

And not much more from Nomura:

- We expect the BOJ to leave monetary policy unchanged at the next meeting. The all-Japan core inflation rate (the general CPI excluding fresh food) has come in at 0.9% y-o-y for three consecutive months through January 2018 and, although the reading has been solid, the results are unlikely to satisfy the BOJ. Yen appreciation versus the dollar since the start of 2018 is another factor that makes it difficult to decide to normalize monetary policy.

Nomura on Kuroda's presser:

- the focus at the governor's press conference will be on questions regarding strong yen against dollar

Yowza! That should be fun! (Press conference scheduled for 0630 GMT)

On the data front, this all prior to the Bank of Japan announcement:

2330 GMT - Japan - Overall Household Spending for January

- expected -1.0%, prior -0.1%

2350 GMT - Japan - Money stock M2 and M3 for February

0000 GMT - Japan - Wages data for January

- Labor Cash Earnings expected +0.7%, prior +0.7%

- Real Cash earnings expected -0.7%, prior -0.5%

Some snippets from Capital Economics on what to expect from the data:

Household spending to rebound

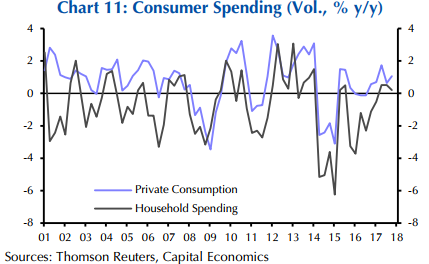

- According to the Bureau of Statistics, household spending dipped ... in real terms in December and only edged up ... last quarter. This fell well short of the ... rise in consumer spending as measured in the national accounts. (See Chart 11.)

There are several reasons for the discrepancy

- First, household spending measures spending per household but the number of households has been rising

- Second, the "Family Income and Expenditure Survey" isn't very reliable. For example, it showed an implausible 23.2% y/y slump in spending on housing in January.

- Finally, the survey covers a few items that don't feed into the national accounts measure of consumer spending.

Either way, we've pencilled in a 1.2% y/y rise in overall household spending in January.

Wages data:

- Wage growth to remain subdued

- regular earnings bounced back in December but the usual see-saw pattern points to a renewed slowdown in January

- we expect labour cash earnings to slow from .. December to ... January. Given that output per employee is rising at a similar pace, wage growth remains far too weak to create major cost pressures.