The Reserve Bank of Australia announces its monetary policy decision - 6 March 2018

- Prior decision 1.50%

- Low rates continue to support Australian economy

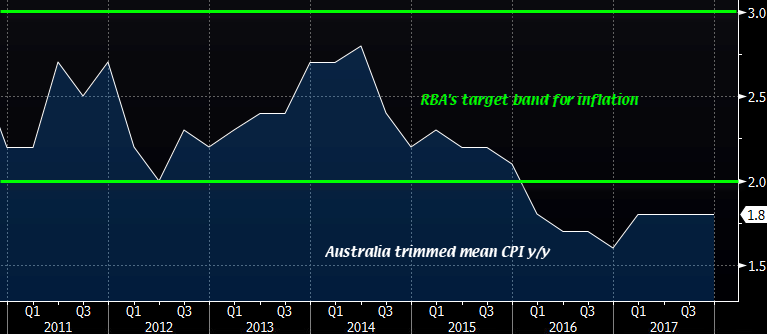

- Inflation likely to remain low for some time

- Reflects low wage growth and strong retail competition

- Progress in jobless rate, inflation expected, likely to be gradual

- Australian economy to grow faster in 2018 than in 2017

- Household consumption remains a source of uncertainty

- Unemployment rate expected to decline gradually

- Wage growth to remain low for some time

- Appreciating exchange rate could slow economic activity, inflation

- Sydney and Melbourne housing markets have slowed

- Outlook for non-mining investment has improved

- Public infrastructure investment supporting economy

No surprises by the RBA here, the expectation is for them to leave the cash rate unchanged and also not tweak its message/language - which at first glance doesn't look like there is anything of note that has changed.

AUD/USD with a bit of a mild whipsaw of about 15 pips, now to 0.7785, pretty much at similar levels heading into the decision.

Pretty much status quo for the RBA and the probability of a rate hike this year remains as uncertain as ever. Unless household debt levels recede and inflation starts to consistently track between the RBA's target band of 2-3%, 2019 is the more likely case for the RBA to raise rates.