The dollar rallied on good news

The message from the market is now clear: The jobs report was good enough to tilt the Fed closer to a rate hike and it signals a better economy ahead.

The tick higher in average hourly earnings, combined with another month of strong job creation means inflation pressures are higher and growth is likely above the 2.0% pace so far this year.

That has to be a sigh of relief for the Fed and economists who have been miffed by the underperformance of the US economy this year despite huge jumps in survey data after the election. The White House might even provide a helping hand soon.

It's only one report but the Fed might start to have a bit of swagger again, we'll hear from NY Fed chief Dudley on Wednesday.

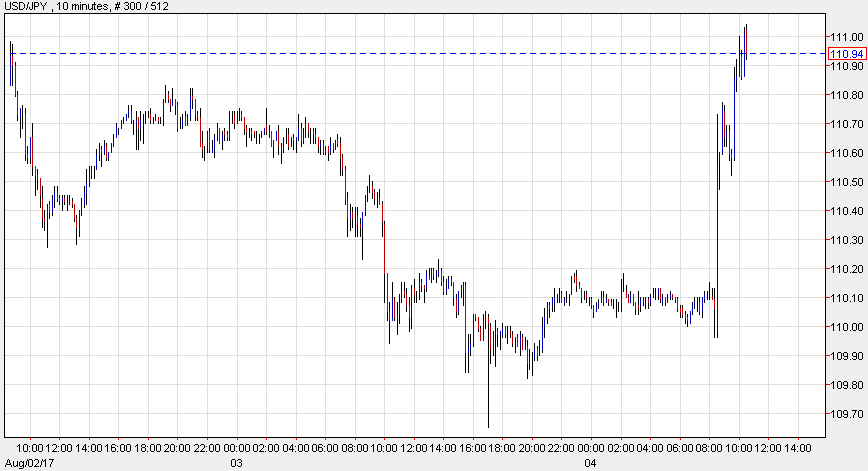

The reaction in the US dollar was tepid at first -- the bulls have been burned before -- but the dollar has been increasingly assertive and is up around a full cent across the board.

At this point, it's far too early to crown King Dollar. It looks a lot like a short squeeze or a bit or profit taking after some very big moves but it's not just today, the US dollar has shown some life throughout the week, especially against AUD, CAD and CHF.

The thing is, if the tide actually turns. If US growth looks like it's closer to 3%, if the Fed hiking cycle is back on, if Congress starts to pass some bills; the upside for the dollar will come quickly and dramatically.