ArticleBody

This via Société Générale, a note from Friday on forex valuation

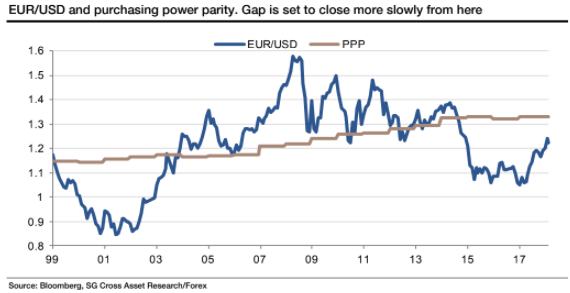

We think old-fashioned purchasing power parity is a useful building block of where 'normal' might be

- suggests that the euro still has some room to rally

In the past 10 years, the EUR/USD spot rate has averaged 1.29

- The OECD's estimate of the EUR/USD PPP fair value has averaged 1.29 too

- That's just a coincidence that contrasts with some of the other currencies (the USD/JPY and EUR/CHF have both fallen far below PPP on average over the last 10, 20 or even 30 years, for example).

The Eurozone, like Japan and Switzerland, has a big current account surplus, but it also comprises a lot of different countries, which affects the FX valuation.... still think that the EUR/USD PPP level (just under 1.34 at the moment) is a reasonable guess of where the long-term EUR/USD average might be going forward.

the euro is less undervalued now that it was, on any measure and relative to past levels of under or overvaluation, it is still 'cheap'.

- explained by ... the 10-year Treasury/Bund spread remains around 200bp in nominal terms, and 150bp in real terms.

- The market can focus on the prospect of bond-buying ending this year and rate hikes coming thereafter, but we've been reluctant to forecast the EUR/USD getting rid of all its PPP undervaluation until the bond-buying is over.

As rates diverge again, a pull-back to 1.2165 (38% retracement of the move since November) or failing that 1.2050 (a 50% retracement) is as good a guess of a place to buy the dip as any.

(bolding mine)