Swiss National Bank now out with latest bulletin 21 March

I've had a quick flick through but nothing of real note that I can see on first sight understandably as the bulletin is generally a summary of recent activity plus a survey of Swiss companies.

Of interest to fx traders, but no great surprise hopefully, might be the section on exchange rates where they note:

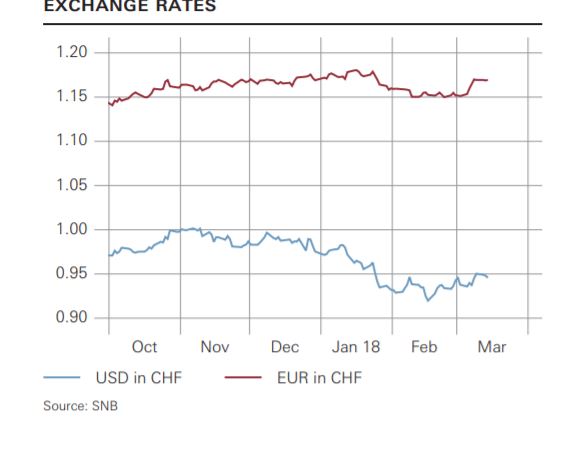

Swiss franc gains against US dollar Since the monetary policy assessment in December 2017, the Swiss franc has gained in value against the US dollar by around 4% (cf. chart 5.4). This appreciation occurred against a backdrop of general US dollar weakness, which became more pronounced at the end of January following statements by the US Treasury Secretary about the advantages of a weak US dollar for the American economy. At times, the USD/CHF exchange rate declined to its lowest level since mid-2015

I've pointed out a number of times, most recently in detail here, that the SNB have a large (35% of reserves) long USDCHF exposure at not a very clever average/last revaluation compared to prevailing rates around 0.9500. My suggestion has long been that they will constantly be in to support the pair, not only per their rhetoric but also in a bid to keep it falling too far for profitability purposes and hence accountability to shareholders. I concede though that they are clever enough to leg some their way out this but at the next reval it's still not to going to sound pretty.

More from the SNB:

Fluctuations in Swiss franc exchange rate to euro Initially, the Swiss franc depreciated somewhat against the euro. At times in mid-January, the price of the euro was CHF 1.18, the highest value since the discontinuation of the minimum exchange rate. Thereafter, however, the Swiss franc strengthened again. This appreciation occurred against a backdrop of growing market uncertainty, which was also reflected in share price performance. In mid-March, one euro cost CHF 1.17, which was practically the same level as at the time of the monetary policy assessment in December.

Slight increase in Swiss franc's trade-weighted external value On a nominal trade-weighted basis, the Swiss franc has increased by more than 1% since mid-December (cf. chart 5.5). This was mainly due to its marked appreciation against the US dollar.

Real external value of Swiss franc still at a high level Since autumn 2017, the real trade-weighted exchange rate index calculated by the SNB has been at roughly the same level as before the discontinuation of the minimum exchange rate. It thereby remains above its long-term average. The same is true for the indices calculation.

Full report here for your perusal, and if you're having trouble sleeping.

USDCHF currently still going nowhere in a hurry at 0.9527 and EURCHF 1.1702 but expect the SNB to be ready to jump on any notable dips.

I'm out of here now. See you all tomorrow. Good luck through the FOMC if you're trading it.

SNB's Jordan - Still got CHF concerns