US November non-farm payrolls are due tomorrow 8 Dec 2017

Here's what you need to know as we head into NFP day tomorrow:

- NFP estimate 195k; prior release was 261k

- Average estimate 197k

- Standard deviation 22.1k

- Highest estimate 260k (Action Economics)

- Lowest estimate 150k (Raymond James)

- Unemployment rate estimate 4.1%; prior release was 4.1%

- Participation rate prior release was 62.7%

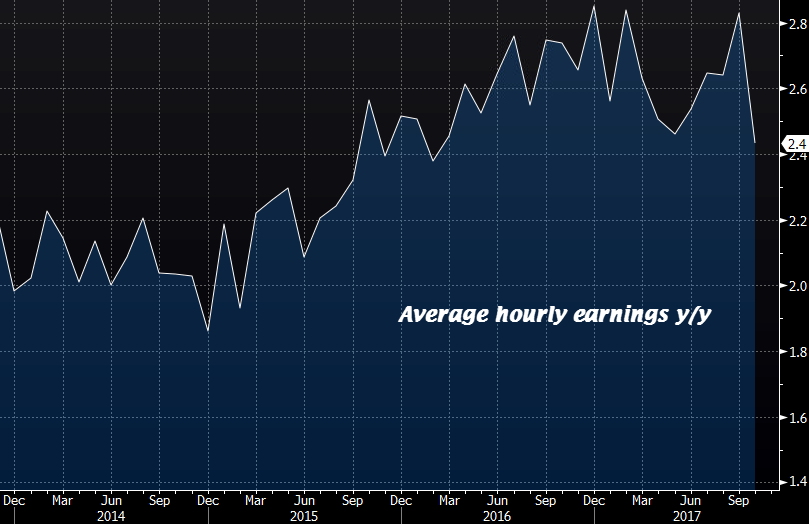

- Average hourly earnings estimate +0.3% m/m; prior was 0.0%

- Average hourly earnings estimate +2.7% y/y; prior was +2.4%

- November ADP employment change 190k

- November ISM non-manufacturing employment index 55.3; prior was 57.5

- November ISM manufacturing employment index 59.7; prior was 59.8

Again, wages will be the key factor here that will make or break the report. And it has been for quite some time. The Fed is looking towards inflation data picking up, and a miss in wages here will not bode well for the dollar as it would likely mean we are not going to see a pick up in inflation.

Adam had a post yesterday about one of the deflationary forces in the US economy. And the thing is these deflationary factors have not been talked about a lot by the Fed (call it ignorance, what you will). Remember Yellen blaming transitory factors like cellphone plans and prescription drugs instead? Yeah, I do.

Anyway, whatever the headline NFP print may be, keep your eyes focused on wages. Last month you could possibly blame it on the hurricane and what not. But my thoughts are not this time around. The wage number, that will be the market mover at the end of the day.