10 year yields are unchanged to up 3 basis point

Spain's IBEX rebounded after the Monday fall on the back of the Catalan "referendum", and is ending the day up 0.5%.

In other European markets:

- France's Cac was up 0.4%

- UK's FTSE was up 0.4%

- Spain's Ibex was up 0.5%

- Portugal's PSI20 was up 0.63%

- Italy's FTSE Mib was down -0.12%.

Germany's stock market was closed for Unification Day. Yesterday it closed at a record level.

In the 10 year debt market today:

- France 0.752, up 1.5 bp

- UK 1.358%, up 3 bp

- Spain 1.723%, up 2.8 bp

- Portugal 2.414%, down -1.4 bp

- Italy 2.166%, up 1 bp

- Greece 5.591%, unchanged

In other markets as European traders look to exit:

- Spot gold is up $2.56 to $1273.54

- WTI crude oil is down -$0.15 to $50.43

- US stocks are modestly. The S&P is up 1.54 points or 0.06%. Nasdaq is up 2.454 points or 0.04%. Dow is up 72 points, up 0.32%

- US yields are down -0.8 bp to down -1.6 bp. 2 year 1.4670%, -1.6 bp 5 year 1.9179%, -1.6 bp. 10 year 2.3301%, -1 bp. 30 year 2.872%, down -0.8 bp

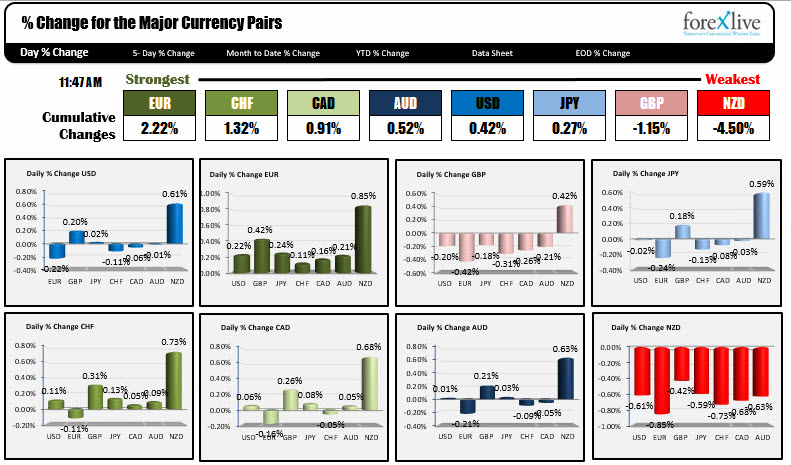

The snap shot of the major currencies, shows the EUR is the strongest (it was the strongest at the start of the NY session) and the NZD is the weakest. It has gotten weaker after a -2.4% decline in Global Dairy prices in the most recent auction (CLICK HERE)