It's all about virtual currencies today, as everything crypto-related is down

Yesterday's close for Bitcoin (from the Bloomberg composite) was almost 21% off the year's high posted just four days back. According to Wall Street definition, we've entered a bear market for Bitcoin.

Today, prices plunged further and touched lows at the $13,000 level. It has rebounded a little now, but it's still down by 6% on the day.

But there seems to be a broader trend at play here. Just when Wall Street is starting to take a peek into Bitcoin and altcoins, a lot of the "old guards" are wanting out.

First, we had Emil Oldenburg selling all of his Bitcoin holdings - to switch to Bitcoin Cash. Then, we had Litecoin founder, Charlie Lee, selling/donating all his LTC holdings - supposedly to avoid a conflict of interest.

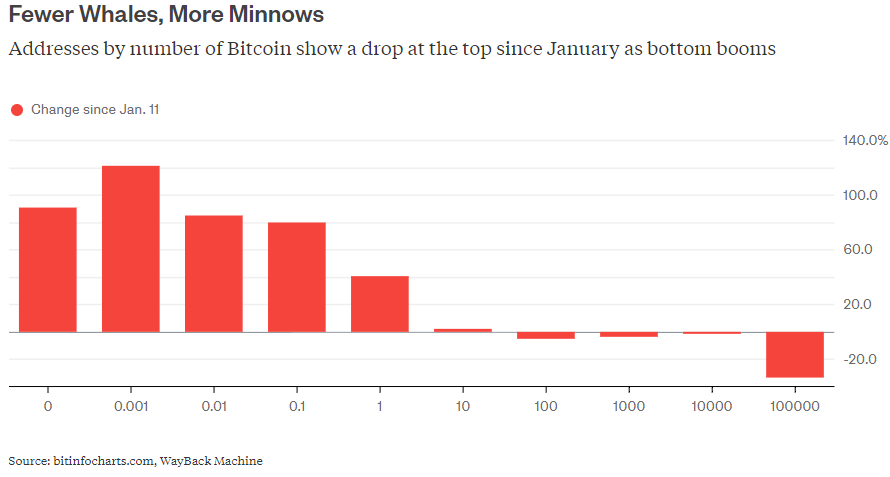

A Bloomberg finding shows that the balance of power for Bitcoin is starting to move away from these "old guards" and it's shifting to the "little guy".

A trawl through the Bitcoin rich list this year, using the Wayback Machine (a non-profit digital archive of the web), shows an explosion in the number of huddled masses holding fractions of the digital token. But the ranks of the Bitcoin-wealthy have thinned. There are more minnows, but fewer whales. Everyone's richer in dollar terms, but the balance of new ownership is shifting to the little guy.

Just when you think Wall Street is starting to play catch up, it looks like the "old guards" are starting to change the rules again. On to the next one, I believe is what they call it.