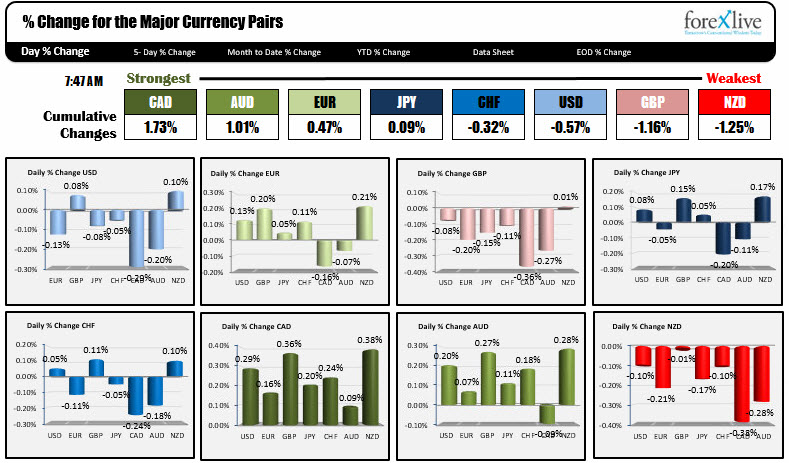

September 13, 2017 Snapshot of the strongest and weakest currencies.

As the North American traders enter for the trading day, the CAD is the strongest currency while the NZD is the weakest. However, the major currencies are bunched together. There is not a whole lot of space. The table from strongest to weakest can shift around. As for the US dollar, the greenback is more negative being down vs the EUR, JPY, CHF, CAD and AUD and up modestly vs. the GBP and NZD.

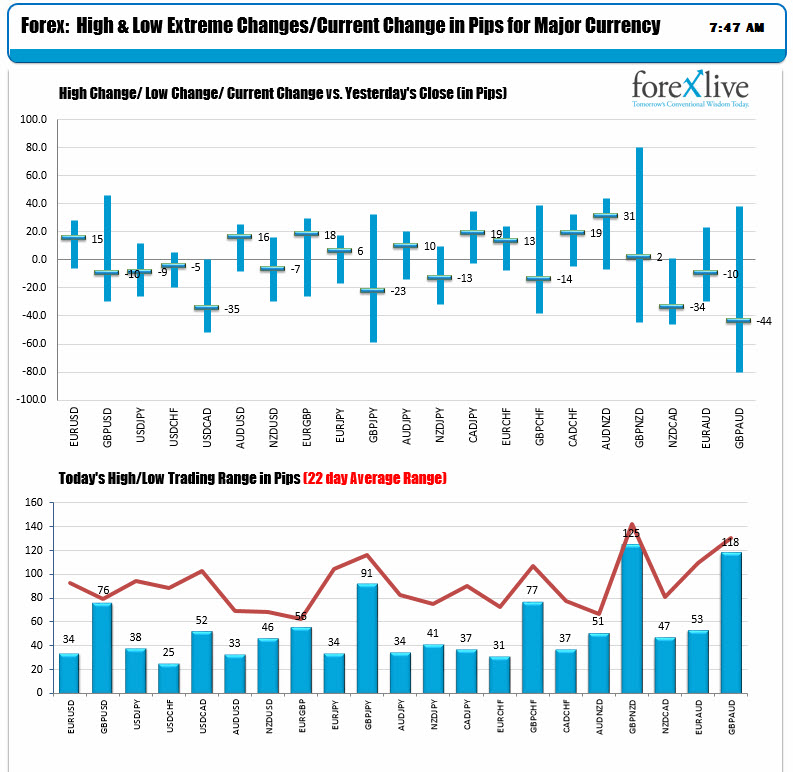

To go with the shmushed pairs is typically less volatility. The below charts show the up and down and the more narrow trading ranges vs. their 22 day average ranges (about a month worth of trading). The GBP pairs did have the most action on the back of the weaker wage data from earlier today. Other pairs like the EURUSD have traded above and below the unchanged line (up 15 pips now) but only has a 34 pip trading range. That is way below the average which stands at 89 pips today. There is room to roam if there is push (getting above the 100 hour MA at 1.19959 or below the 50% and 200 hour MA at 1.1957 and 1.1950 respectively will be eyed).

A look at the other markets shows:

- Spot gold is up $2.00 at $1333.80

- WTI crude is up $0.45 at $48.69. The private inventory data came out last night and showed crude oil inventories rose 6.181mm. The estimate is for a rise of 4.911M for DOE data to be released at 10:30 AM ET/1430 GMT

- The US yields are trading around unchanged levels today. 2 year 1.3350%, 5 year 1.7438%. 10 year 2.1637%. 30 year 2.7661%

- US pre-market stocks are a little lower. S&P futures are down -3 points. Nasdaq futures are down -11 points and the Dow futures are down -14 points

- European stocks are mostly higher. The UK FTSE is down -0.2%. German Dax up 0.1%. France Cac up 0.1%

- 10 year yields in Europe are little changed. Germany unchanged at 0.401%. France unchanged t 0.693%. UK 1.142%, unchanged.