The USD has some strength

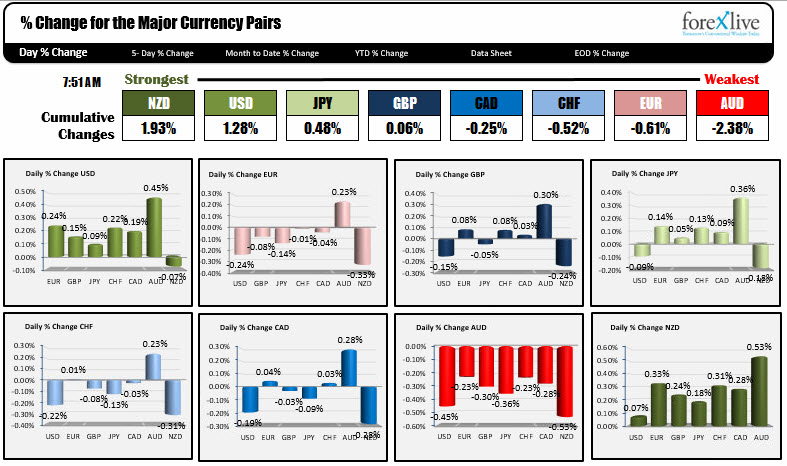

As the NA traders enter for the day, the snapshot of the gainers and losers is showing that the NZD is the strongest and the AUD is the weakest. The USD has some strength as the market prepares for Powell II as he heads back to Capitol Hill today to testify to the Senate this time. The market will be looking for direct hints that he is ready to go to 4 vs 3 tightenings in 2018.

Also on the schedule is initial jobless claims (at 8:30 AM ET), Markit US manufacturing PMI (9:45 AM ET), ISM manufacturing (10 AM ET) and US construction spending (10 AM ET). Canada will release the Markit manufacturing PMI (9:30 AM ET). Powell's testimony will begin at 10 AM ET.

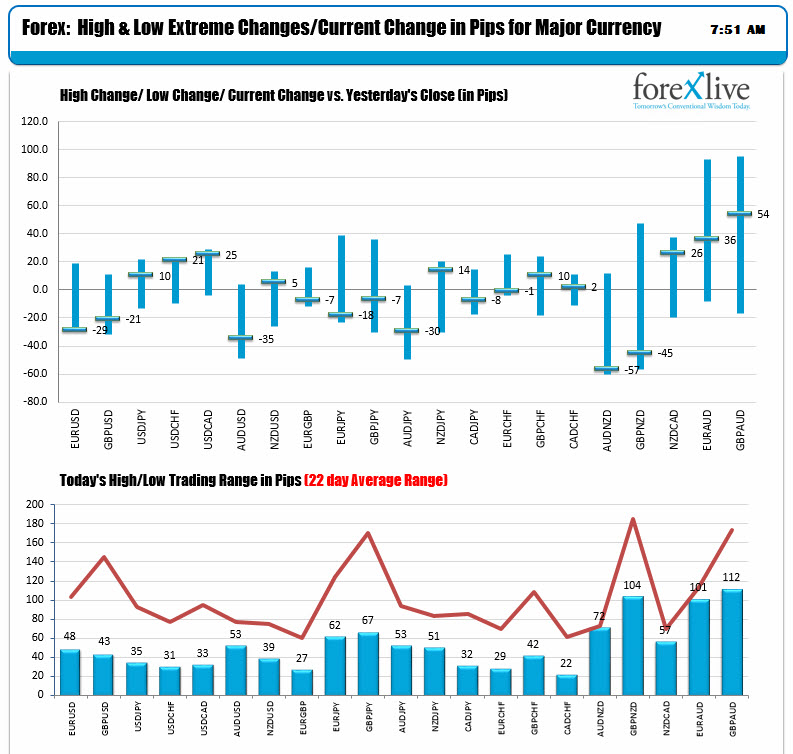

The volatility of the market is not up to the recent price ranges (over the last 22 days or month of trading). All of the major currency pairs vs. the USD are well below their 22 day average range (red line in the lower chart below). There is room to roam and extend those ranges.

The picture was similar on Tuesday before Powell's testimony and he certainly helped to push the dollar higher. We will see if his more hawkish tone two days later - and with the vision of what he said and how he said it - changes. Does he want to keep the same tone or alter it a little. That is the advantage of 2 days of testimony (not matter how painful they can be with the wasted chatter).

A snapshot of other markets are showing

- spot gold getting a head start on more bearishness perhaps. It is down $-11.70 or -0.89% at $1306.67

- WTI crude oil futures are trading down $.54 or -0.88% at $61.10

- Bitcoin is trading up $134 at $10,665. The fall at the and of the day yesterday took the price down to its 200 hour moving average and bounced. The 200 hour moving out is currently $10,197 while the 100 hour moving averages at $10,253.

The US stock futures are lower:

- NASDAQ futures are down 16 points

- S&P futures are down by -8.5 points

- Dow futures are down by -110 points

US yields are lower despite worries of higher rates:

- two-year 2.2419%, -0.8 basis points

- 5 year 2.61%, -3.0 basis points

- 10 year 2.83%, -3.0 basis points

- 30 year 3.102%, -2.2 basis points

In Europe at midday:

- Germany's DAX is down -1.59%

- France's CAC is down -1%

- UK's FTSE is down -0.8%

- Spain's Ibex is down -1%

- Italy's FTSE MIB is down -0.9%

10 year yields in Europe are lower

- Germany's 0.628%, -2.9 basis points

- France 0.899%, -1.9 basis points

- UK 1.444% -5.7 basis points

- Spain 1.507%, -3.1 basis points

- Italy 1.954%, -2.0 basis points

- Portugal 1.951%, -3.9 basis points