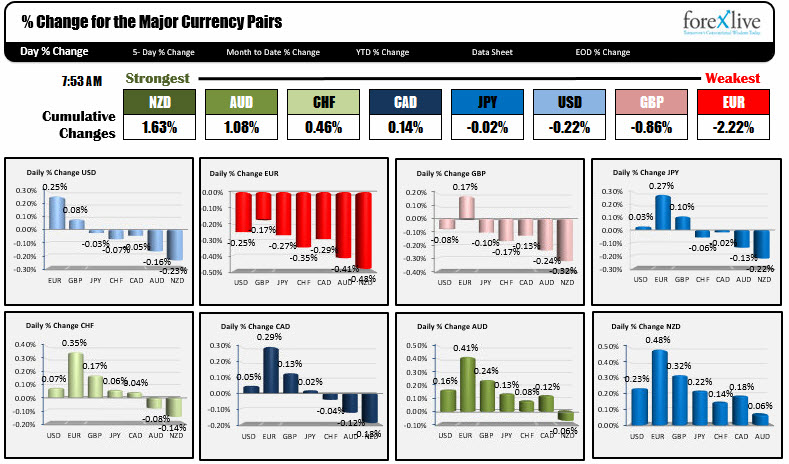

The NZD is the strongest. The EUR is the weakest.

As North American traders enter for the trading day, the NZD is the strongest, while the EUR is the weakest. The strongest and weakest are relatively compacted together today, with the summer malaise to blame (and lack of data). Tomorrow however, we will be working through the ECB statement and press conference. Today, not a lot of stuff going on. The USD has less than 0.1% changes vs the GBP, JPY, CHF, CAD. The greenback is up 0.25% vs the EUR and down -0.23% vs the NZD. The dollar is -0.16% vs. the AUD in the morning snapshot.

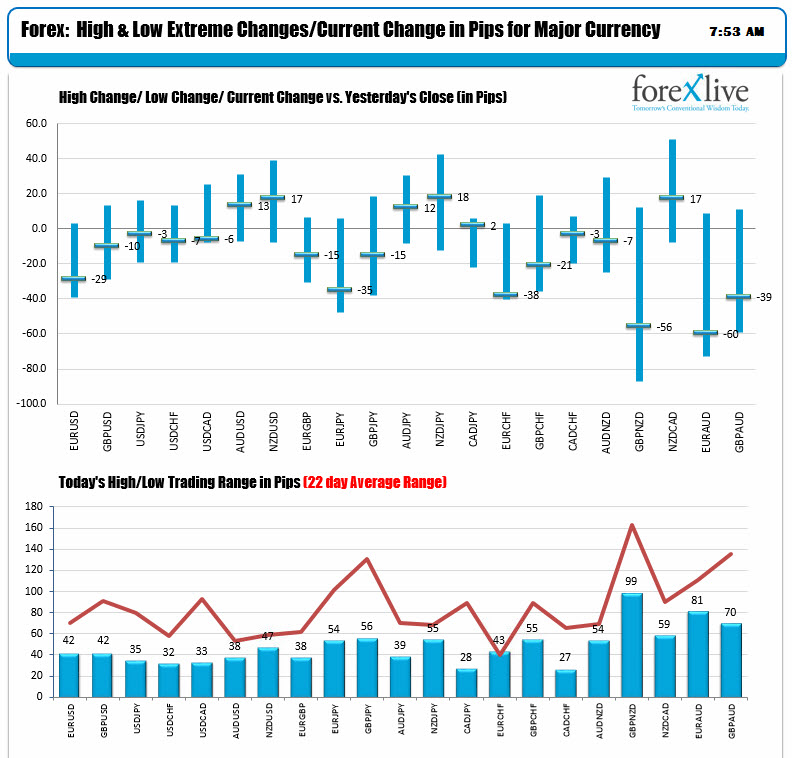

The ranges and changes are reflective of summer time market. The low to high ranges (see lower chart below), shows the vast majority (the exception is the EURCHF) of the pairs are well below their 22 day averages. There is room to roam but there needs to be a catalyst for the push. That might not come until tomorrow (ECB) but we always have our eyes open.

Today we do have US housing starts (1160K est vs 1092K last) and building permits (1201K vs 1168K last) will be released at 8:30 AM /1230 GMT. The DOE inventory data will be released at 10:30 AM/1430 GMT. Crude oil is expected to see a drawdown of -3500K vs -7564K last week. The private survey released last night showed a surprise build (+1628K) but gasoline had a draw down of -5448K (the DOE is estimate to have a draw down of -1300K).

In other markets today, the snapshot shows:

- Crude oil is little changed at +$0.04 at $46.43

- Spot gold is down -$1.70 to $1242.26

- US yields are unchanged to up 1 bp across the curve. Not much change there.

- US stock futures are little changes. S&P up 1.75 points. Dow unchanged. The Nasdaq futures, off a new record close yesterday, is up 13 points in pre-market trading (the S&P closed at a record yesterday as well). The Nasdaq has been up 8 straight days.

Below are the major stock earnings releases to come this week:

Wednesday: DISH Network, Morgan Stanley, Qualcomm, American Express, Unilever

Thursday: eBay, E*TRADE, Microsoft, NCR, Corp, Phillip Morris International, American Airlines

Friday: GE, Schlumberger, Colgate-Palmolive, Honeywell