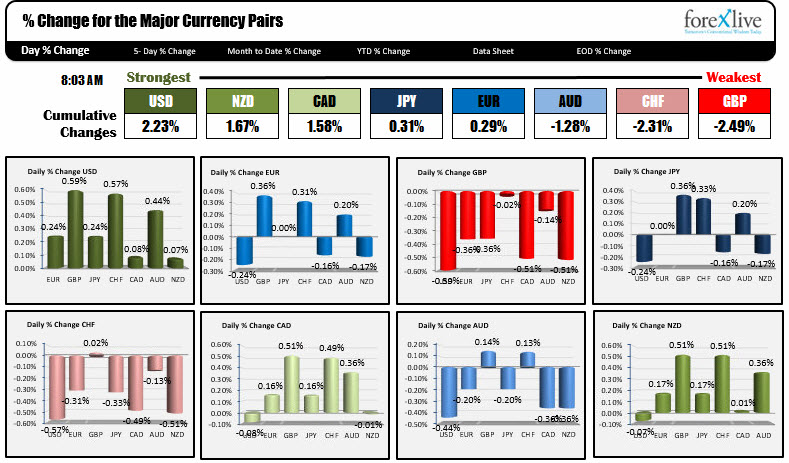

The USD is the strongest. The GBP is the weakest.

The snapshot of the strongest and the weakest show that the USD is the strongest while the GBP is the weakest. The GBP fell before the retail sales on Brexit concerns (and less favorable technicals) and the better retail sales data did not do enough to turn the tide to the upside, and the selling returned (see Mikes post here). The USD is seeing some upside momentum after its recent declines. The USDJPY's fall below the 50% retracement, 100 and 200 day MsA yesterday (at 111.637 to 111.88) could not be sustained and we are seeing a rebound in that pair. The AUDUSD also moved lower after their employment data came in as expected.

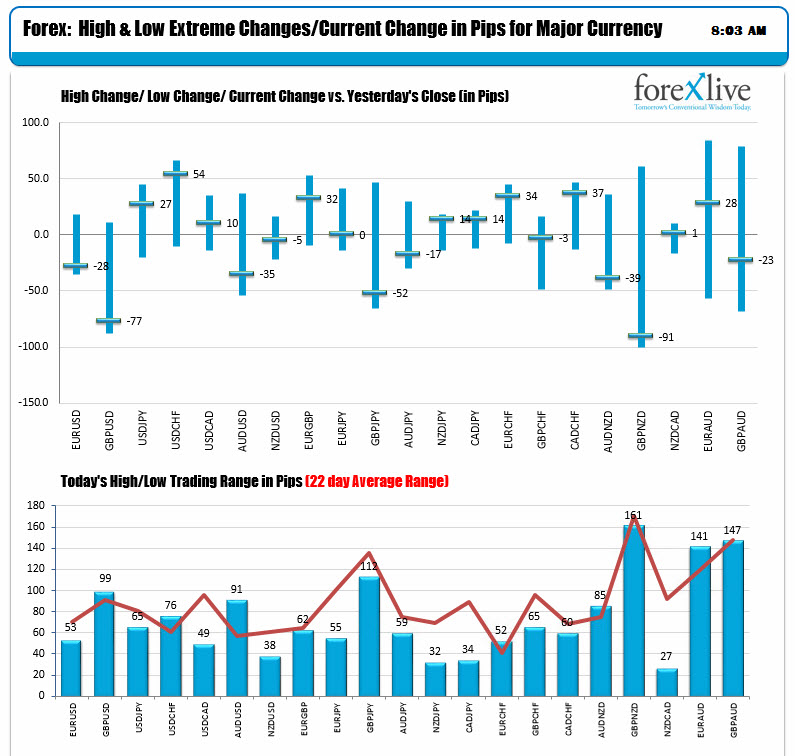

The volatility is up after the news filled day, with a number of pairs up to and over their 22 day trading ranges (red line in the lower chart below). The EURUSD is still below it's average with Draghi to come.

In other markets this morning:

- Spot gold is trading down -$2.50 to $1238.75

- WTI crude is trading up $0.24 to $47.36 (and away from the $47.00 level). The low reached $46.95 today

- The US stock futures are up in pre-market trading. Dow futures up 21 points. S&P futures up 4.0 points. Nasdaq futures up 16.25 points. They all closed at record levels yesterday.

- US yields are lower with 2 year at 1.348%, down 1 bp. 5 year 1.808%, down 1.5 bp. 10 year 2.253% down -1.6 bp. 30 year 2.830%, down -2.0 bp