August producer price index up next

The economic calendar is light for North American traders today but there are a few notable events.

The first is at 8:30 am ET (1230 GMT) when the August producer price index numbers are out. The consensus is for a 2.5% rise overall and 2.1% y/y climb in core.

Will it move markets? Probably not. For all the focus on inflation, PPI data is full of noise. If anything, expect a bit of US dollar strength and continued momentum if it's a bit on the strong side.

At the same time as the US release, Canadian house price data from Teranet is due out. We'll be watching to see how Toronto looks. Moody's was out with a report this week saying Canadians should expect 5 years of flat-to-declining prices except in Toronto, where they believe they will rise 7% per year.

Weekly US oil inventories are sure to be skewed by Harvey once again. That makes them very tough to trade. They're out at 10:30 am ET (1430 GMT).

What might be the surprise market mover on the day is the 30-year T-bond sale at 1 pm ET (1700 GMT).

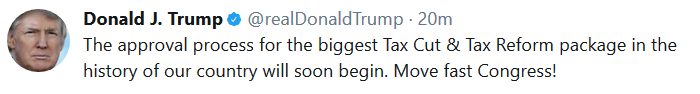

With no big drivers there, watch out for politics and China headlines because they could steal the show. Trump is already tweeting about tax reform.