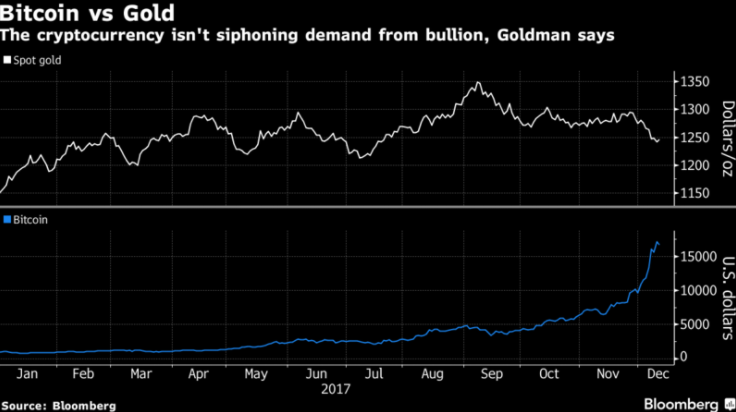

This according to Goldman Sachs' analyst notes on 11 Dec

The report argues that Bitcoin's market cap of $275 billion is easily dwarfed by gold's $8.3 trillion, and the lack of liquidity in Bitcoin means it will unlikely convince investors who are looking to diversify their assets or hedge - to move away from gold.

The reasons they lay out on why Bitcoin won't be substituting gold are:

1. Vastly different investor pools

Gold investors using ETFs, futures, and commodity indices are automatically covered by anti-money laundering regulations. Meanwhile, cryptocurrencies have little clarity on complying to these rules, which makes it a hurdle for professional investors.

2. No discernible outflows in gold ETFs

There is no "mass exodus" in gold, as total known holdings in bullion-backed ETFs are near highest levels since May 2013.

3. Market characteristics of gold and Bitcoin are vastly different

The demand for Bitcoin attracts more speculative inflows - as opposed to gold. And the market dynamics are different considering Bitcoin has a mathematically certain total supply but gold has a finite (but uncertain) supply.