Not much to get excited about today

US stock futures are lower but Treasury yields are 2-4 bps higher across the curve. The driver in the final 8 hours of the trading week will probably be developments on tax reform from Congress, or something else on the geopolitical front (looking in your direction Saudi Arabia and North Korea).

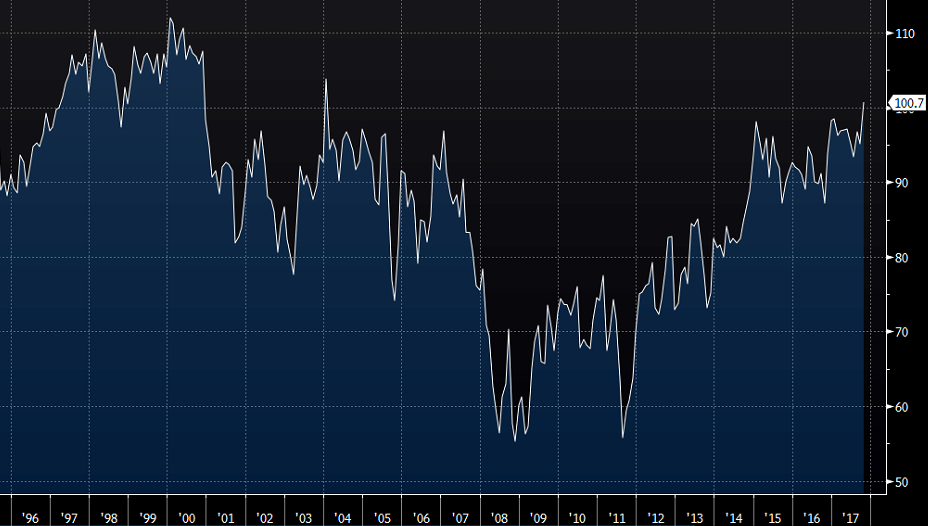

In terms of data, the U Mich consumer sentiment could be a reminder that the economy is picking up. The final October reading was 100.7 and today's Nov prelim number is forecast to tick to 100.9, which would be the highest since 2004.

For more of what's coming up, check out the economic calendar.