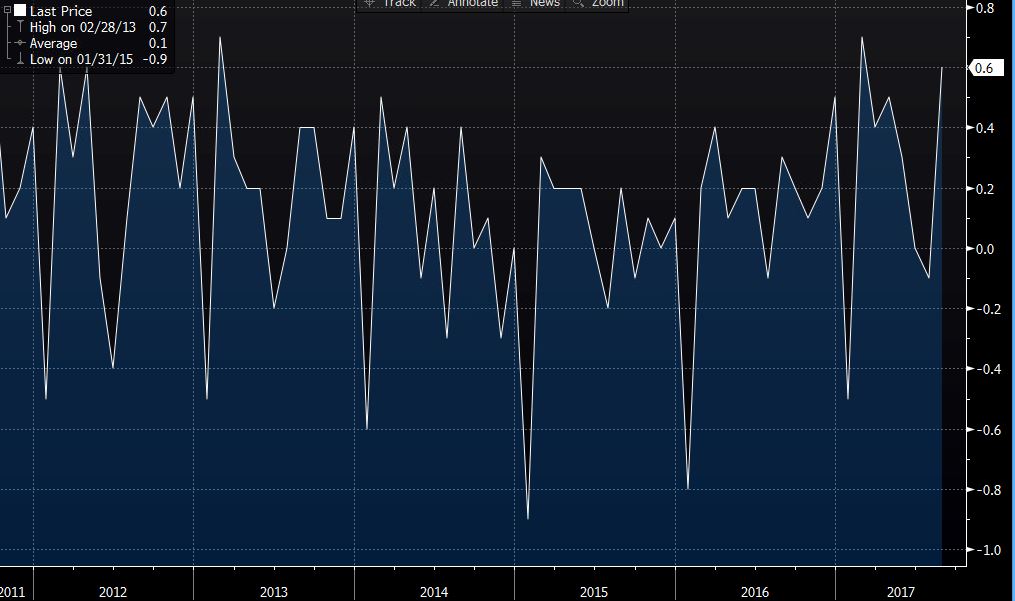

Latest UK inflation data now out 12 Sept

- -0.1% prev

- yy 2.9% vs 2.8% exp vs 2.6% prev

- core CPI yy 2.7% vs 2.5% exp vs 2.4% prev

- RPI mm 0.7% vs 0.5% exp vs 0.2% prev

- yy 3.9% vs 3.7% exp vs 3.6% prev

- retail price index 274.7 vs 274.3 exp vs 272.9

- RPI ex mortg paymts yy 4.1% vs 4.0% exp vs 3.95 prev

- PPI output mm NSA 0.4% vs 0.1% exp/prev

- yy 3.4% vw 3.1% exp vs 3,2% prev

- core PPI output mm 0.2% vs 0.1% exp vs 0.2% prev up from 0.1%

- yy 2.5% vs 2.3% exp vs 2.5% prev up from 2.4%

- PPI input mm 1.6% vs 1.3% exp vs -0.2% prev revised down from 0.0%

- yy

- HPI yy July 5.1% vs 4.8% exp vs 5.1% prev revised up from 4.9%

Good headlines see GBPUSD blow through 1.3230 as per my preview and halt at 1.3250 atm . EURGBP down to 0.9022

Worth a short up here (1.3245) but beware second wave of buying. Dip demand now into 1.3220 and 1.3200 Larger sell interest 80-00

Says the ONS on CPI:

- Rising prices for clothing and motor fuels were the main contributors to the increase in the rate between July and August 2017.

- Air fares also rose between July and August but the rise was smaller than between the same two months a year ago and so resulted in a partially offsetting, downward contribution.

Full ONS reports on all the data here