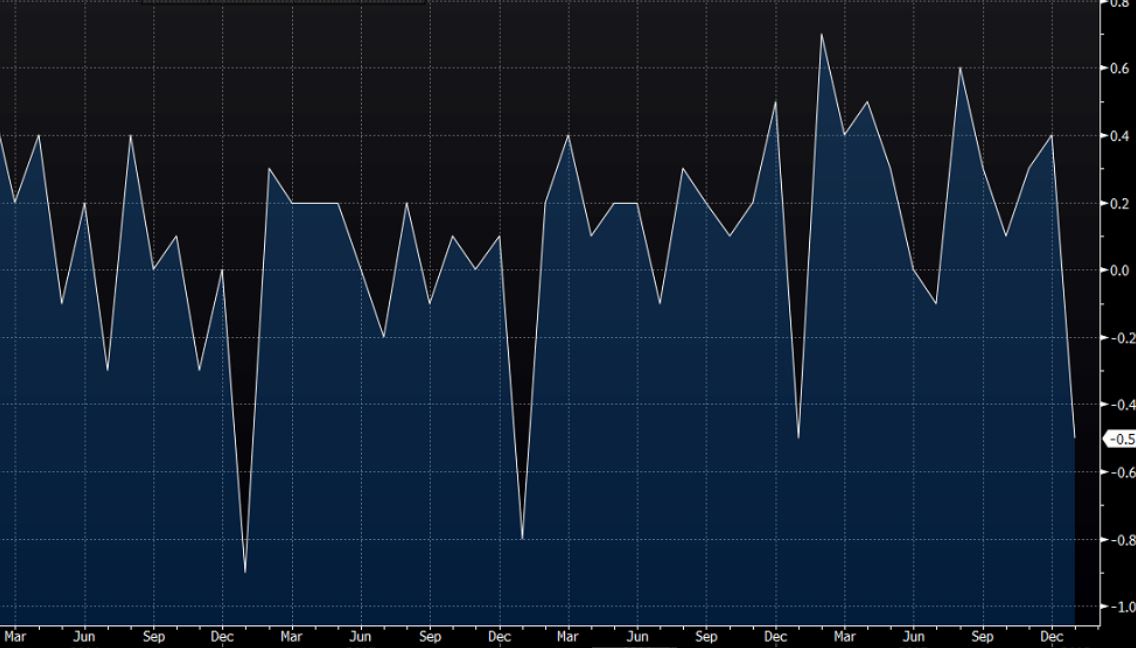

Latest UK inflation data now out 13 Feb

- 0.4% prev

- yy 3.0% vs 2.9% exp vs 3.0% prev

- Core CPI yy 2.7% vs 2.6% exp vs 2.5% prev

- CPIH yy 2.7% vs 2.8% exp vs 2.7% prev

- RPI mm -0.8% vs -0.7% exp vs 0.8% prev

- yy 4.0% vs 4.0% exp vs 4.1% prev

- RPI ex mortge payments yy 4.0% vs 4.1% exp vs 4.2% prev

- Retail Price Index 276.0 vs 276.2 exp vs 278.1 prev

- HPI yy 5.2% vs 4.9% exp vs 5.0% prev revised down from 5.1%

Better headlines and core sees GBPUSD testing 1.3900-10 but a case of buy rumour/sell fact IMHO. Let's see if we get any second wave but I did warn in my preview I'd be ready to jump on any knee-jerk rally.

Core CPI stronger than exp/prev but CPIH and RPI mm softer. PPI a tad softer too

CPI lends a little support to BOE's more hawkish view last week but we'll learn more over next few months' readings.

Update 09.32 GMT: GBPUSD 1.3870 EURGBP 0.8879 GBPJPY 149.36

Says the ONS:

- The largest downward contribution to change in the rate came from prices for motor fuels, which rose by less than they did a year ago.

- The main upward effect came from prices for a range of recreational and cultural goods and services, in particular, admissions to attractions such as zoos and gardens, for which prices fell by less than they did a year ago.

Full report here

Savage crash - RIP Cryptocurrencies? Five insights from the ASAC Fund.