For January/February, due at 0930 GMT

A couple of quick bank what-to-expects (bolding mine)

Barclays:

- We expect the unemployment rate to be unchanged at 4.4%. The marginal decline in January's claimant count remains consistent with the current rate. Core earnings growth is likely to accelerate mildly. Wage pressures indicated in recent surveys are likely to feed in with a lag over the coming months.

Nomura:

- While the unemployment rate rose in last month's report, jobs were up too. Focus will once again be on earnings, especially private sector/ex-bonuses, where annualised growth over the past six months has been 3.5%.

Daiwa:

- we expect ... earnings growth nudged up 0.1ppt to 2.6%3M/Y in January. Additionally, after the unemployment rate rose for the first time in sixteen months in December, to 4.4%, we expect it to have remained unchanged in January, while employment may have increased by 100k between November and January.

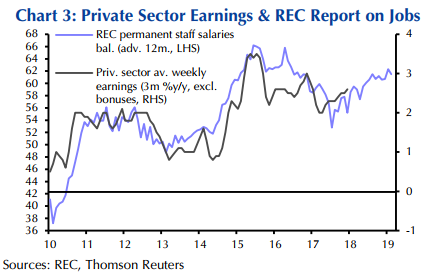

Graph via Capital Economics - the consultancy looking for:

- jobs growth continued (expect quarterly gain in employment of 85K, annual rate at 1%. ... unemployment rate 4.3%)

- pay growth has gained further momentum (a rise from 2.5% to 2.7% in the headline (three-month average) measures of average earnings)