UK inflation data now out 14 Nov

- 0.3% prev

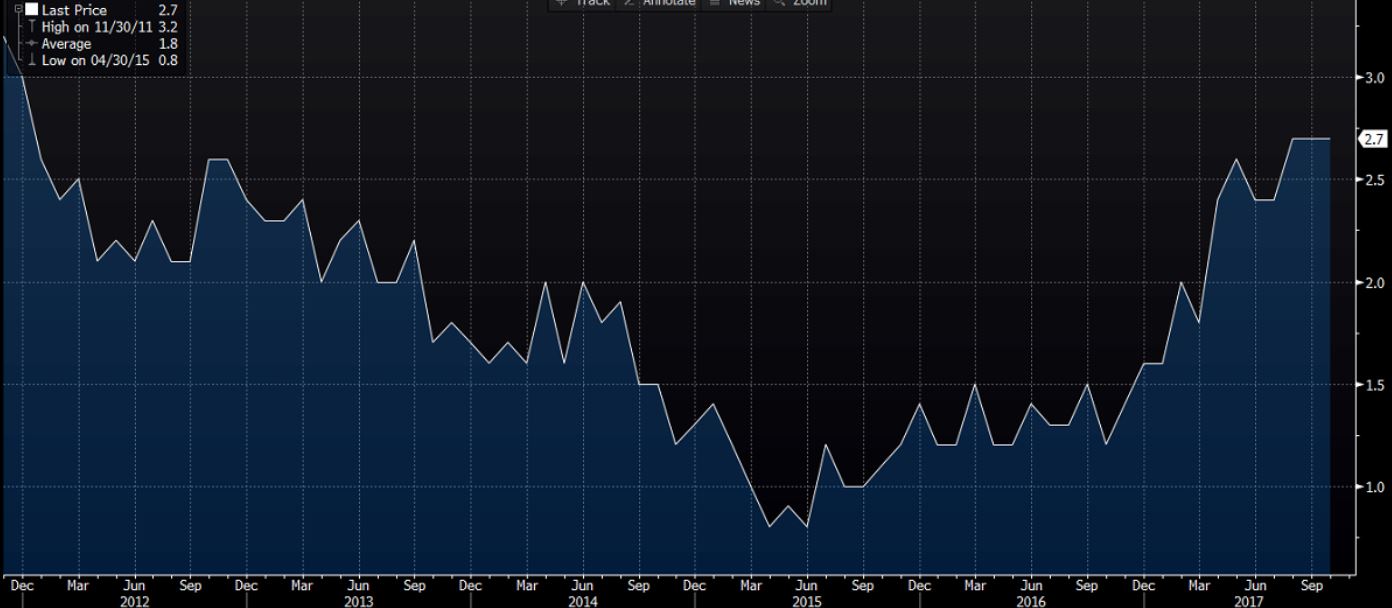

- yy3.0% vs 3.1% exp vs 3.0% prev

- CPIH 2.8% vs 2.9% exp vds 2.8% prev

- Core CPI yy 2.7% vs 2.8% exp vs 2.7% prev

- RPI mm 0.1% vs 0.2% exp vs 0.1% prev

- yy 4.0% vs 4.1% exp vs 3.9% prev

- index 275.3 vs 275.5 vs 275.1 prev

- RPI ex mortg paymts 4.2% as exp vs 4.1% prev

- 4.60% - PPI Input NSA (Y/Y) Oct: (est 4.80%; prev R 8.10%)

1.00% - PPI Input NSA (M/M) Oct: (est 0.80%; prev R 0.20%)

2.80% - PPI Output NSA (Y/Y) Oct: (est 2.90%; prev 3.30%)

0.20% - PPI Output NSA (M/M) Oct: (est 0.30%; prev 0.20%)

2.10% - PPI Output Core NSA (Y/Y) Oct: (est 2.20%; prev 2.50%)

0.10% - PPI Output Core NSA (M/M) Oct: (est 0.20%; prev R -0.10% - HPI yy 5.4% vs 4.8% prev revised down from 5.0%

GBPUSD down to 1.3075 on the softer data. Either way the topside was limited as per my preview. EURGBP up to 0.8955 helped by general EUR demand this session.

Overall ranging still and Carney & Co speaking shortly so don't get too greedy

I'm off to stick my fingers in the freezer.

Says the ONS:

The inflation rate for food and non-alcoholic beverages continued to increase to 4.1%, the highest since September 2013.

Rising prices for food and, to a lesser extent, recreational goods provided the largest upward contributions to change in the rate between September 2017 and October 2017.

The upward contributions were offset by falling motor fuel and furniture prices, along with owner occupiers' housing costs, which remained unchanged between September 2017 and October 2017, having risen a year ago.

Full CPI report from ONS here and PPI here