Latest UK public borrowing report now out 20 Oct

- GBP 4.1bln revised from 5.1bln

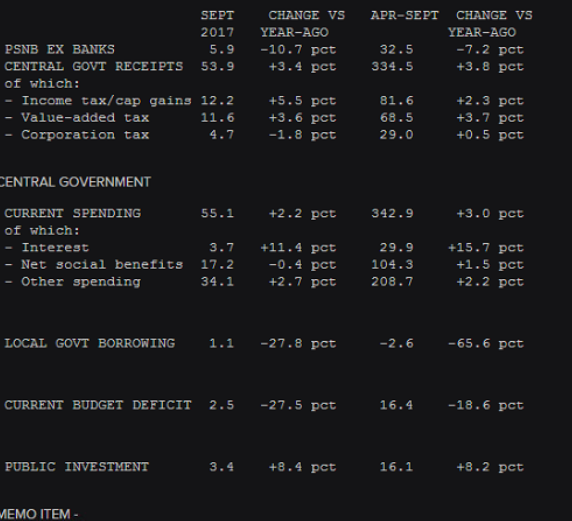

- PSNBR ex banking groups GBP 5.9bln vs 6.5bln exp vs 4.7bln prev revised from 5.7bln

- PSNCR GBP 11.205bln vs 0.339bln prev

- central govt NCR GBP 19.3bln vs 1.1bln prev

Smallest Sept PSNBR (budget deficit) ex banks since 2007 which in theory is good news for the UK govt at least.

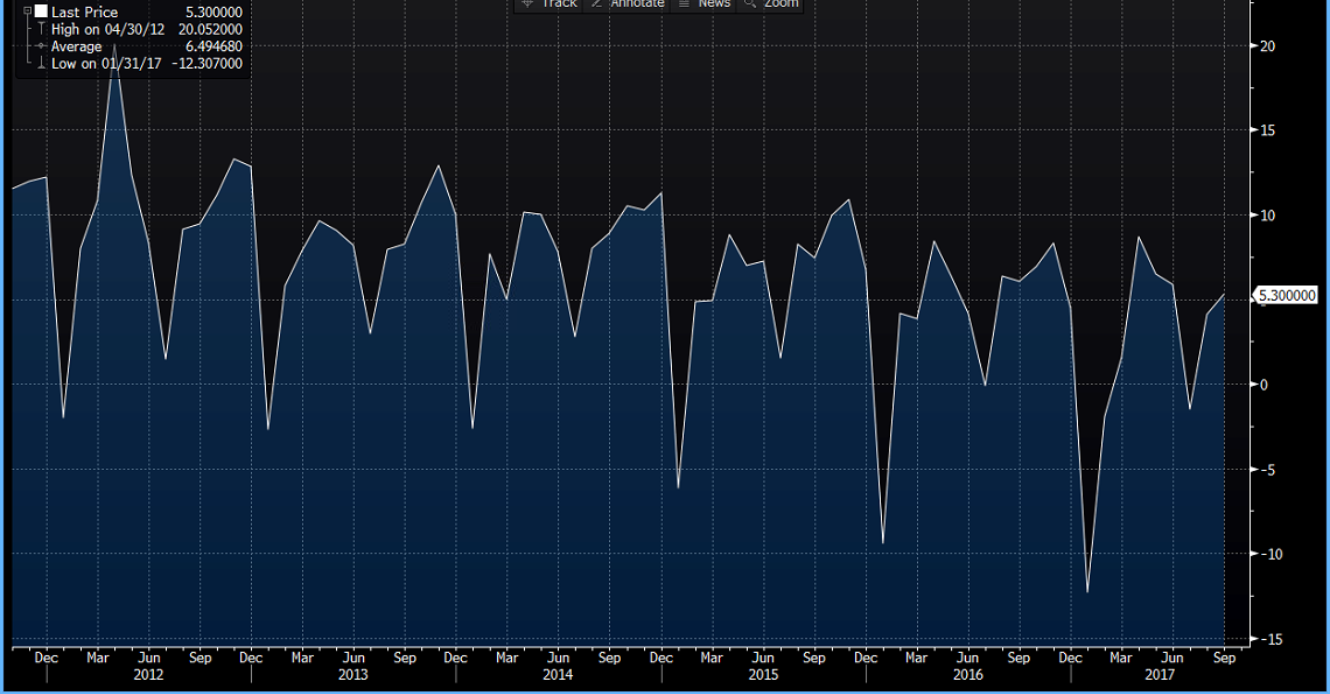

Public Sector Net Borrowing measures the difference in value between spending and income for public corporations, the central government, and local governments during the previous month. A positive number indicates a budget deficit, while a negative number indicates a surplus.

ONS notes that:

- Borrowing in financial YTD 32.5B, 2.5B lower than a yr-ago

- September 2017 borrowing of 5.9B is 0.7B lower than same period 2016

- September 2017 net borrowing is the lowest YTD read since 2007

- Stamp Duty, VAT and income tax all contribute to receipts this month

- Current expenditure 0.9B, largely from Goods & Services

- VAT receipts have risen consecutively since April 2015

Full report from ONS here

GBPUSD 1.3145 as EURGBP continues its slide to test 0.8975-80 bids/support