I have posted some previews earlier, so as part of collating them into one place, the links:

And, if you read this far, bonus previews (ps. everyone pretty much looking for a pullback from the January blow out result)

Via Nomura:

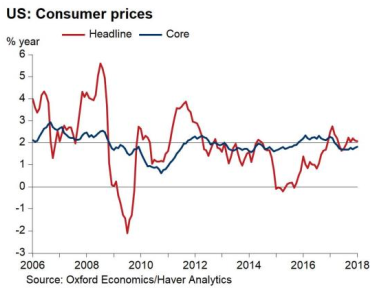

After a surprisingly strong reading of 0.3% (0.349%) m-o-m in January, we expect a steady 0.2% (0.203%) m-o-m increase in core CPI for February, raising the year-on-year rate to 1.9% (1.88%).

- Core goods prices in January increased strongly, up 0.4% m-o-m, driven by a sharp pick-up in apparel prices. However, we do not believe this pace is sustainable and expect core goods prices to revert somewhat in February.

- In addition to apparel, we believe prices for new and used vehicles may have declined during the month as the transitory boost from hurricane-related factors wanes, adding further downward pressure on core goods prices.

- On the upside for core goods, a decline in medical care commodity prices in January should prove largely transitory and we expect a modest increase for February.

- For core service prices, we expect a moderate increase in rent inflation, a rebound in prices of lodging away from home and a modest decline in airline fares.

Aside from core, we expect a slowdown in food price inflation to 0.1% m-o-m from 0.2% in January, as food at home prices was likely flat during the month.

- Energy prices in February likely declined by 0.2% on a seasonally adjusted basis.

Taken altogether, our forecast for headline CPI in February is 0.2% (0.158%) m-o-m, corresponding to 2.2% (2.23%) on a 12-month basis.

Via Oxford Economics:

- We expect headline CPI to rise just 0.1% in February as energy prices look to detract from the overall reading.

- However, due to low year-ago comparisons, the year-on-year rate moves up to 2.2% from 2.1% in January.

- We estimate that core CPI rises 0.2%, keeping the year-on-year rate at 1.8%.