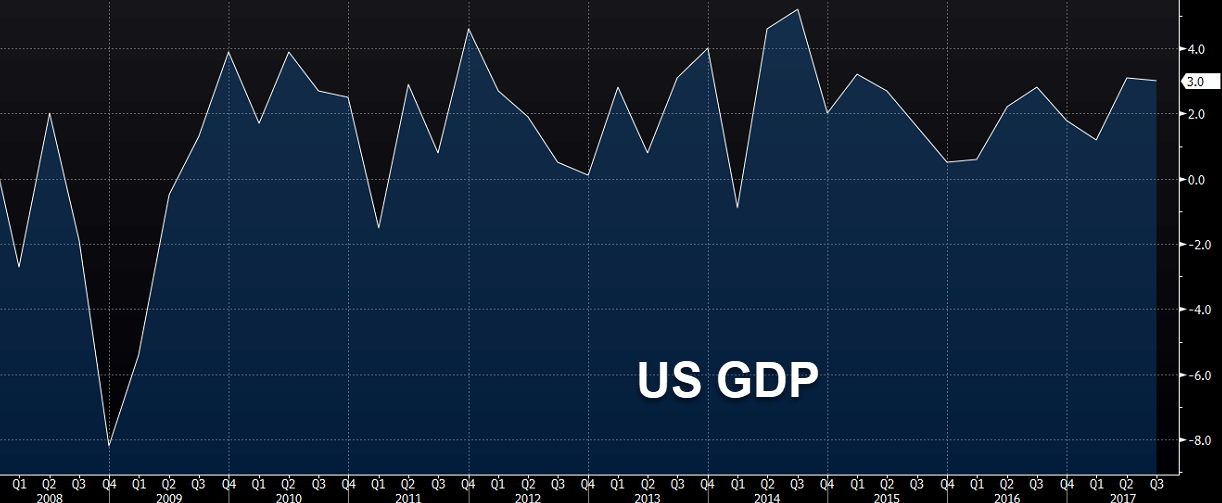

The first look at third quarter 2017 US growth

- Estimates ranged from +1.8% to +3.6%

- Q2 reading was +3.1%

- Personal consumption +2.4% vs +2.1% expected

- Prior personal consumption +3.3%

- GDP price index +2.2% vs +1.7% exp

- GDP deflator +2.1% vs +1.8% exp

- Core PCE +1.3% vs +1.3% exp

That's very strong nominal growth because of the bump in the price index. That's a screaming incentive for the Fed to hike rates in December and to keep the 'gradual' pace going in March, maybe more if Taylor gets the top job.

Details:

- Final sales +2.3% vs +2.6% exp

- Consumer spending on durables +8.3%

- Business investment +3.9%

- Investment in equipment +8.6%

- Investment in IP +4.3%

- Home investment -6.0%

- Business investment in structures -5.2%

- GDP ex motor vehicles +3.5%

- Inventories add 0.73 pp to GDP

- The Commerce Dept said it could estimate the overall impact of the hurricanes

The inventory number will unwind in the future so that's a bit of negative news but housing investment is the flipside. It's been weak for two quarters but with house prices strong, it won't stay weak, so that should be a tailwind in Q4 and beyond.